Disclaimer:

The information provided in this Substack is for informational and educational purposes only and does not constitute financial product advice, investment advice, or a recommendation to buy, sell, or hold any financial products. The content is general in nature and does not take into account your personal financial objectives, situation, or needs.

While reasonable efforts are made to ensure the accuracy, completeness, and reliability of the information presented, no representation or warranty, express or implied, is given as to its accuracy or completeness. All opinions expressed are those of the author and are subject to change without notice.

I am not a licensed financial adviser. You should consult a licensed financial adviser, tax professional, or legal advisor before making any investment decisions. Investing involves risk, including the potential loss of capital, and past performance is not indicative of future results.

The author may hold positions in the securities mentioned and will disclose such holdings where relevant. Any mention of specific securities, investments, or strategies should not be interpreted as a recommendation.

By accessing and reading this content, you acknowledge and agree that the author is not liable for any loss or damage arising from any decisions you make based on the information provided. You are solely responsible for your own investment research and decisions.

I hold a position in Vonovia.

Vonovia is one of the largest real estate companies in Europe, currently trading at a significant discount to its net asset value. In addition to owning real estate, its scale gives it a significant competitive advantage in the highly regulated German and larger European apartment market. There are some risks associated with this, but these are being managed by the business and already working.

Reason For Investment

According to Vonovia’s 2022 annual report the current value of Vonovia’s net tangible assets are 57.48 Euros per share. However Vonovia’s current price per share is 24.50 per share. Since August 2021 Vonovia’s share price has fallen from a high of 60 Euros in August 2021 to 24.5 more recently. Investing in a company simply based on it trading at a discount to its net tangible assets isn’t always wise, as many factors can lead to such assets not getting a decent rate of return or the value of the assets being overstated. However in the case of Vonovia it’s assets do generate significant amounts of cash and have been shown in relatively recent public transactions to be at least close to the stated values

What Vonovia Does

In Vonovia’s own words:

“Vonovia’s business model is based on the rental of good-quality, modern and, most importantly, affordable living space, the development and construction of new apartments, both for its own portfolio and sale to third parties, and the provision of housing related services. These housing-related services mainly relate to cable TV, automated meter reading and senior-friendly apartment modernization. This is supported by our caretakers and by our established craftsmen’s residential environment organizations.”

So Vonovia gets most of its revenue from owning and renting apartments, but also makes some money constructing apartments and performing property management services for others. It is based in Bochum, North Rhine-Westphalia Germany and as of its 2022 annual report manages 621,303 apartments mostly across Germany but also in Austria and Sweden, making it the largest owner of apartments in Europe.

Vonovia started with a privatization of rail worker housing in the 90’s and has since grown through mergers and acquisitions. It went public in 2013 and is today a member of the DAX40 and STOXX European 600.

Competitive advantages

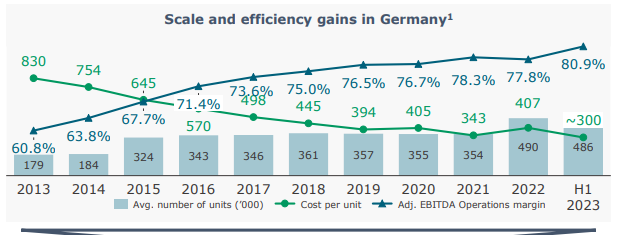

Due to the size of Vonovia’s portfolio and its work over the years to increasingly concentrate its portfolio in particular areas of Germany and standardize those apartments it has managed to lower the cost of apartment maintenance significantly.

Leading to higher operating margins and the ability to maintain apartments across Germany at a much lower cost than others.

In addition to this Vonovia’s scale allows it to add value to its apartments in ways in which other smaller owners of apartments cannot. Vonovia is able to conduct research with its Energy Centre of the Future to test out various ways to improve the energy efficiency of its apartments. It can also make investments in the communities of its buildings into parks and other community projects due to controlling multiple buildings that can add value that owners of individual apartments cannot.

Finally as will later be discussed the German rental market is highly regulated and generally speaking in environments with high levels of regulation larger organizations are better able to analyze and meet the regulations in a more efficient way than much smaller entities. They can spread out the cost of complying with higher regulation across more apartments.

German Apartment Rental Industry

Renting is a lot more common in Germany than other countries with approximately 54% of German households renting their homes. This is one of the lowest rates of home ownership in Europe and can be attributed to greater tenant rights and regulations.

This can be seen in rental regulations. Since the 1970’s Germany has had a system rental regulation known as ‘Mietspiegel’ where rental increases are pegged to a reference rent for similar quality local dwellings, established at regular intervals.

In 2015 an additional law was passed allowing states to further moderate rents for new leases in cities or municipalities to ensure rents can only rise up to 10% above local comparisons. As a result historically the rents have followed inflation but at a delay.

Since the 2008-2009 period the number of new constructions in Germany has gone down and more recently there has been a persistent gap between government housing targets and actual completions. This has been attributed to a shortage of skilled labour, complexities of the building code and high land prices.

Two other large German residential landlords are: Deutsche Wohnen, which operates in many similar markets to Vonovia and LEG Immobilien who largely operates in North Rhine-Westphalia.

Historic Income

Historically Vonovia has had very stable income from rents. Although Vonovia has done a great job historically of providing high quality accommodation to its tenants. The stability of income can also be attributed to the rental regulation. When rents are held below the price of rent the market would otherwise achieve there are less rental properties and more demand for rental properties than can be supplied.

In addition rents don’t fall as much during recessions because they don’t go up as much during boom times.

Despite regulations, Funds From Operation (FFO) per share (a better metric than profit for real estate companies) over the past 10 years have increased by about 11% per annum. Dividends per share were also quite stable until 2022 when Vonovia had to cut them due to debt issues brought about by higher interest rates (discussed later under balance sheet). But this cut has been called a temporary measure by management to deal with the initial shock of higher interest rates. Vonovia has a long term objective of 70% of group FFO to shareholders as dividends.

Balance Sheet

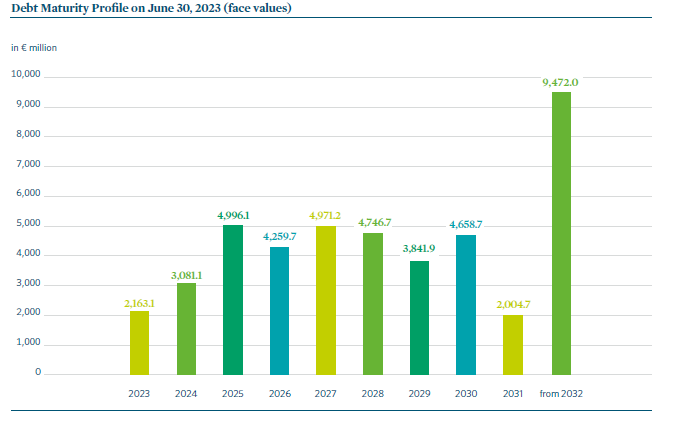

Vonovia carries an investment grade credit rating from S&P of BBB+ with a stable outlook. This means S&P believe it has adequate margin to meet its financial commitments. As of 30th of June 2023 it has a net debt of 43,179 million Euros of Debt at a very low average rate of 1.5%. But over the next several years as the debt matures it will either need to be paid off or rolled over at a much higher interest rate.

Vonovia intends to pay off a significant amount of the debt over the next few years rather than renewing it at higher interest rates.

Vonovia estimates it will generate about 2 billion Euros of cash annually before any asset disposals or dividend changes. In addition by reducing the dividend they will generate an additional 500 million Euros of cash annually. Finally they also plan and have made some progress of making additional asset disposals of 2 billion Euros this covering their future debt maturities in 2023 and 2024.

On the asset disposal front Vonovia has so far made two major asset disposals this year to Apollo and CBRE. The 1 billion Euro sale to Apollo took place at a rate that was only 5% below book value as at the end of Dec 2022. This disposal is within our margin of safety reported at the beginning of the article for Vonovia’s net asset value per share.

Management Team

There are 5 executives on the management board at Vonovia they include:

Rolf Buch - the Chief Executive Officer (CEO), who has been with Vonovia since 2013

Arnd Fittkau - The Chief Rental Officer (CRO), who has been with Vonovia since 2002. The CRO is responsible for the property management business.

Philip Grosse - The Chief Financial Officer (CFO), who has been with Vonovia since 2022

Ruth Werhahn - The Chief Human Resources Officer (CHRO), who has been with the company since 2023

Over the past few years at Vonovia there have been quite a lot of insiders buying much of it at much higher prices than we have today, by multiple members of the management board. The last insider purchase was 5,500 shares by Philip Grosse the CFO on the 8th of May at 18.29. Over the course of 2022 management bought the largest number of shares in my records buying just under 1 million stocks for just over 30 million dollars at an average price of $30.76. In 2023 there has been much less buying despite the lower prices, maybe most of the executive maxed out their holdings in 2023.

Valuation

Vonovia looks very cheap on a number of different metrics.

On the 3rd of November 2023 it was trading at 24.5 Euros per share and according to their 2022 annual report it made 2.56 Euros per share in Funds From Operations (FFO) putting Vonovia at a P/FFO of 9.57 times. Historically they have traded for nearly twice this on average.

Another way of valuing a real estate company is looking at the total value of the real estate per share and what that real estate would actually be worth. According to Vonovia’s 2022 annual report the current value of Vonovia’s net tangible assets are 57.48 Euros per share. This puts Vonovia’s current share price at a 64% discount to the value of its current assets. Historically Vonovia has traded at a premium to book value ranging from 10%-50%.

This discount to net tangible assets seems very promising, however it is based on how realistic Vonovia’s estimates of its assets actually are and the returns it can get on these assets. Vonovia’s apartments have a total living area 29,989,860 square meters and its estimate of the value of all these apartments is 88,242.8 million Euros, which puts a value on each square meter of living space at 2,942 Euros. This is reasonable levels when compared to market values in some of Vonovia’s main cities. With costs of inflation and other factors it may soon even be below replacement cost.

Finally as another check on the reasonableness of Vonovia’s valuations on its books you have its recent transaction with Apollo. Apollo is a private equity firm and likely isn’t paying prices significantly above market values when it buys real estate. It bought 1 billion Euro share on some of Vonovia's real estate at a 5% discount to book value (well within Vonovia’s stock discount of 64%). However this wasn’t just the apartments Apollo bought a non-controlling interest which you would expect to be at some sort of discount.

Risks

There are a number of risks Present in Vonovia’s stock today:

Political: The first risk is political. The German real estate market is highly regulated and highly political. This high level of regulation, known as ‘Mietspiegel’ ensures that on average revenues are a lot more stable across the economic cycle as rents are probably overall lower than they would otherwise be. Governments may try pushing this further by further lowering allowable rent increases or forcing sales of these properties, which has been discussed in Berlin politics.

If rents were further restricted this likely wouldn’t be in Germany’s long term interest because as stated earlier since 2008-09 there has been a persistent gap in the number of rental dwellings Germany needs and the number being built. In addition the persistently low vacancy rates in Vonovia of 2% (1.8% in Germany) relative to other US apartment REITs indicates at current rents there is strong demand for Vonovia’s apartments.

In terms of compulsory acquisition of apartments (example article below):

https://www.theguardian.com/commentisfree/2021/sep/29/berlin-vote-landlords-referendum-corporate

Germany is a country with strong rule of law and any compulsory acquisition would need to be performed at fair market prices, which as has been determined above is at least a premium of 64% to the current value of Vonovia’s stock.

Balance Sheet

The next major risk related to Vonovia is its balance sheet which carries 43,179 million Euros of Debt. This has been discussed above. Vonovia currently has already raised enough in cash from free cash flow, asset sales and a lower dividend to repay nearly the next two years of bond maturities. This gives it additional time to build up more cash from general operations as well as further assets sales.

Vonovia obviously doesn’t have to repay all of its debts and can renew the bonds, but given the higher interest rates these will likely be renewed at higher interest rates, making paying off a significant portion preferable.

German Economy

There are a number of articles in the financial press about the German economy's decline over the past 12 months. According to Reuters the German economy suffered a recession from the 4th quarter of 2022 to the first quarter of 2023. Economies go through recession and the German economy has gone through a number of negatives recently from the Covid lockdowns, as well as the war in Ukraine and sanctions of Russia significantly increasing its cost of energy.

However Germany has a large diversified economy, with a highly skilled workforce that have allowed it to adapt to change and problems in the world before and likely will again. So it may be experiencing problems at the moment but its strength means these should likely be temporary.

Summary

Vonovia stock is currently selling at a 64% discount to the conservative value of its assets. This discount leaves a considerable margin of safety for investors creating an asymmetric risk reward situation.

There are risks associated with this investment from Vonovia’s debt load to German politics. However all of these are manageable and Vonovia has plans in place to address these that are already showing positive results.