Teleperformance: An Artificial Intelligence (AI) Loser or a Cheap Compounder Experiencing a Few Bumps after Covid?

Disclaimer:

The information provided in this Substack is for informational and educational purposes only and does not constitute financial product advice, investment advice, or a recommendation to buy, sell, or hold any financial products. The content is general in nature and does not take into account your personal financial objectives, situation, or needs.

While reasonable efforts are made to ensure the accuracy, completeness, and reliability of the information presented, no representation or warranty, express or implied, is given as to its accuracy or completeness. All opinions expressed are those of the author and are subject to change without notice.

I am not a licensed financial adviser. You should consult a licensed financial adviser, tax professional, or legal advisor before making any investment decisions. Investing involves risk, including the potential loss of capital, and past performance is not indicative of future results.

The author may hold positions in the securities mentioned and will disclose such holdings where relevant. Any mention of specific securities, investments, or strategies should not be interpreted as a recommendation.

By accessing and reading this content, you acknowledge and agree that the author is not liable for any loss or damage arising from any decisions you make based on the information provided. You are solely responsible for your own investment research and decisions.

I hold a position in Teleperformance.

Key Reason for Purchase:

Teleperformance has long been a strong founder led performer for shareholders. As the dominant player in outsourced customer experience management, it has cemented its position in the market. It has consistently grown earnings per share in the low double digits and maintained industry-leading margins. However, due to the impacts of COVID-19 and other short-term factors, its stock price has experienced significant volatility, shifting from highly expensive to very cheap not only relative to its historic premium but relative to the market as well. Despite these fluctuations, the industry still holds substantial growth potential, making Teleperformance a compelling investment opportunity.

One primary concern investors have expressed about Teleperformance is the potential disruption from generative AI, especially following the release of ChatGPT. While generative AI has the potential to significantly enhance the service and efficiency of customer experience across the global economy. It is unlikely to entirely replace humans and its adoption is not straightforward, creating greater barriers to entry for customer experience outsourcing businesses. Teleperformance is well-positioned to lead this transition. With its vast data resources, deep expertise, and robust client relationships, the company is better equipped than its customers and competitors to effectively integrate AI and other technologies into its operations.

What Does Teleperformance Do?

Teleperformance provides “outsourced customer experience”, this means they communicate with customers on behalf of their clients using methods such as phone, text and social media. The main medium Teleperformance uses to communicate with customers is the telephone, operating call centres is what they are known for accounting for just over 70% of revenue.

Their business is split into two areas:

Core Services and Digital Integrated Business Services (D.I.B.S): Core Services and D.I.B.S covers a broad service offering including: customer care and technical support, content moderation (and related services), customer acquisition and loyalty, digital marketing, integrated complex back/middle/front-office services, Operations Consulting for Business Services, Digital Experience and Customer Integration.

Specialized Services: Specialized Services include niche high value added businesses. The five main areas of specialised services are:

i) Recruitment and employee screening (PSG Global Solutions),

ii) US health services and navigation (Health Advocate),

iii) Translation and interpretation (LanguageLine Solutions),

iv) Consumer debt collection (Alliance One) and

v) Travel visa outsourcing (TLS Contact).

Core Services and D.I.B.S accounted for 6,982 million Euros or 83% of revenues in 2023 and Specialized Services accounted for 1,363 million Euros or 17% of revenues in 2023.

Risk of AI Disruption

The risks of AI disruption are a pressing concern for many investors, so it's essential to address them upfront. Since the release of ChatGPT in November 2022, AI has demonstrated its ability to engage in realistic and informative conversations with humans. This capability might lead some investors to believe that Teleperformance's clients will soon realise they can cut costs by replacing the company with generative AI models for customer communication. Despite improvements since ChatGPT's release, generative AI models are not yet ready to fully replace human interaction. Moreover, implementing AI or other complex systems into critical processes like customer experience is far more complicated than simply switching on a model. Finally Teleperformance is already making progress with this technology and other ongoing projects aimed at ensuring it provides the most efficient and high-quality service to its clients.

Generative AI is an impressive tool, particularly in its ability to answer human questions and provide assistance through chatbots. However, since ChatGPT became the first widely popular chatbot, several limitations have been recognized:

Hallucinations: Chatbots can sometimes generate false information, a phenomenon known as 'hallucinations.' Since chatbots are designed to produce text that sounds plausible, they might fabricate details that aren't true. This is a significant limitation, as companies cannot risk providing their clients with incorrect information.

Limited Creativity: Chatbots are trained on a finite dataset, and when faced with situations outside this dataset, they may deliver incorrect or irrelevant responses. This constraint limits their ability to handle unique or novel situations effectively.

Lack of Emotional Intelligence: Chatbots lack the ability to understand and respond to human emotions. Emotional intelligence is often a crucial component of human interactions, allowing for adaptive communication based on the customer's emotional state. This deficiency means chatbots may struggle in situations where empathy and nuanced understanding are required.

Despite the drawbacks of using chatbots or other forms of generative AI, such as those mentioned above, there are ways to incorporate AI into business processes and create valuable products that minimise these limitations. Successfully doing so requires not only deep knowledge of AI but also extensive expertise in the specific area where AI is being implemented (subject matter expertise) and access to a large data pool for training. These requirements favour industry incumbents like Teleperformance, who possess both the necessary expertise and data resources.

The basic steps for implementing an AI automation service may be along the lines of:

Gathering Subject Matter Experts, AI Experts, and Available Data:

In this initial step, subject matter experts and AI experts collaborate to identify potential automation services that AI can perform. They focus on tasks within the subject matter experts' domain that can add the most value and that they. After identifying a suitable task, they assess if they have sufficient data to train the AI.Model Building:

AI experts then develop a model that best fits the available data to perform the required task. This model is incorporated into a user-friendly program that can be easily used by non-technical staff.Iteration in Small Groups:

Once the program is operational, it is tested by a small group of employees. These employees use the tool in their daily tasks and provide feedback on any issues or improvements needed. Developers then refine the tool based on this feedback.Iteration in Larger Groups:

After the smaller group is comfortable with the AI tool, it is rolled out to a larger group. These users continue to report any bugs or issues, which developers address. If the tool is not customer-facing, it may be fully deployed after this stage.Supervised Implementation for Customer-Facing Tools:

For customer-facing tools or those set to operate autonomously, the next step involves supervised implementation. Employees monitor the AI system as it interacts with customers, intervening or taking over when the AI makes mistakes. As well as ensuring the AI system says and does the right thing, as well as how customers respond to the system. This phase also starts with a small group and gradually expands to more users.Final Deployment with Human Oversight:

Once the AI tool has proven effective for most customer interactions, it is fully deployed. However, a group of humans remains on hand to handle complex cases or when the AI encounters difficulties.

Thus the process of implementing AI is a complex and iterative process, if Teleperformance is unable to implement this new technology like they have with past technologies, the quality of their services may suffer. Although Teleperformance isn’t an expert in AI it does have the other components to successfully implement AI in its business: subject matter experts, data and real world situations. According to the Teleperformance 2023 annual report Teleperformance is currently working on over 100 different projects to incorporate generative AI to improve its business. Teleperformance has a long history of using various types of technology to improve the efficiency and quality of its services.

Below is a summary of improvements various types of automation have helped with at Teleperformance:

* AHT stands for Average Handle Time

Video of Daniel Julien discussing how AI is used in Teleperformance as well as its limitations:

Moat

Throughout its history, Teleperformance has achieved remarkable revenue growth. As revenues have increased, the company has leveraged its scale to enhance service quality and efficiency, resulting in expanded margins. Concurrently, the customer experience outsourcing industry is seeing heightened barriers to entry due to new country-specific requirements in each client sector. These requirements pertain to remote work arrangements, omni-channel security, and technologies essential for customer satisfaction, further driving the trend towards outsourcing.

Country specific knowledge

One of the key areas Teleperformance was able to add value to clients in its early days and still today is outsourcing call centre work to countries with lower wages. Hiring workers and conducting call centres and other work in different countries to the underlying business is not straightforward as different countries have different labour laws, data storage laws and a whole host of different laws and work practices. Working between multiple countries creates significant fixed costs in staying up to date with all the laws, practices and culture between the countries. Teleperformance can spread these fixed costs across all of its clients creating low cost services than any of its customers or smaller competitors.

Knowledge base

Teleperformance provides services across a wide variety of areas such as: debt collection, technical support, claims management, language translation, digital visa management, healthcare process management, sales and other customer experience areas. In order to provide these services efficiently and with a high degree of quality they need good knowledge of the underlying area and strong processes in place to ensure employees cover everything involved. Teleperformance level of knowledge and processes in place to service clients act as a barrier to entry with any client having to build up a similar base of knowledge and processes. Some examples of this would be enough knowledge of the US healthcare system to know what to advise clients to do. This knowledge and processes can then be applied to other clients in similar or adjacent areas. For example if a new country decides to use Teleperformance to assist with digital visa processing they can use existing processes and tools from other countries' digital visa process.

Technology

The risk of technological disruption was discussed earlier in the article, it was concluded that it's possible but Teleperformance has key advantages in developing technology for customer experience. These advantages lie in its scale: it has more data, subject matter experts and real life situations to analyse and evaluate new technology allowing it to develop technology more efficiently. Throughout its history it has so far managed to use this advantage and develop technologies allowing it to increase its margins with its growth.

In addition technology in this sector creates a barrier to entry not only making it difficult for new entrants to enter the industry but also Teleperformance customers to service their own customer experience as well as Teleperformance could. Teleperformance has a range of computer programs and other technologies that make their workers more efficient and high quality. For example their company AllianceOne which is a major player in the North American debt collection market uses an artificial intelligence-based analytics platform using insights into consumer propensity to pay alongside segmentation collection models to understand customer characteristics and payment patterns. This allows AllianceOne to make sure each collection effort is optimised to the customer and so less effort is wasted. This shows how running a call centre or other customer experience platform is no longer just a matter of organising some people in an office to take and receive calls, but also requires technical expertise that takes time and effort to acquire.

Scale of offer to customers

Teleperformance is a very large company with operations in 99 countries as of its 2023 annual report. This gives it a larger menu of options it can offer to its customers to better meet their needs. With operations in so many countries Teleperformance can offer customers call centres and other customer experience personnel at various price points, across various time zones and across various languages. In addition with expertise across so many different niche areas of customer experience such as: sales, technical support, recruitment, debt collection, visa renewal and translation it likely already has efficient processes it has learnt from servicing other clients to more efficiently meet the customers needs.

Earnings and General History

Teleperformance was founded in 1978 in Paris by Daniel Julien, has seen remarkable growth under his leadership as the current Group Chairman and CEO. Daniel also holds a significant ownership stake (1.2 million shares as of the 2023 annual report). After establishing dominance in the French market, Teleperformance went public on the Paris Stock Exchange in 1986 and subsequently expanded into Europe. In 1993, it entered the US market with the opening of its first contact centre, and by 2007, following further international expansion, it solidified its position as a global leader in the customer experience outsourcing industry.

Despite achieving industry leadership in 2007, Teleperformance has continued to experience rapid growth. This growth can be attributed to the fragmented nature of the customer experience industry, coupled with expansion driven by both global economic growth and increased recognition among companies of the value of outsourcing these services. Throughout its history, Teleperformance has capitalised on this growth by capturing market share in an industry that expands above the global rate due to increasing outsourcing trends. Moreover, the company has continually improved efficiency in servicing its clients while maintaining or enhancing quality. Consequently, Teleperformance has not only seen revenue growth but also expanded margins and accelerated earnings growth.

Teleperformance earnings benefited from the COVID-19 pandemic, receiving additional work from clients who needed extra call centre support and from those who could no longer conduct their operations in-house. The company was well-prepared to handle the increased demand, thanks to its extensive work-from-home policy and infrastructure, which were already in place as part of past cost-saving measures. As a result, Teleperformance's earnings and stock price spiked during the pandemic. However, in 2023 and beyond, these COVID-related contracts have started to expire, leading to a normalisation of earnings. Additionally, macroeconomic uncertainty has caused some clients to scale back, further impacting earnings. While the company experienced a decline in earnings in 2023, it is not unprecedented and does not establish a new trend, especially given Teleperformance's long history of impressive multi-decade growth.

Customer Experience Outsourcing Industry

According to Everest, a consultant, the customer experience outsourcing industry represents a total market of US$114 billion, with Teleperformance revenues in 2023 representing about US$9 billion (8.345 billion Euros). This is with an estimated outsourcing rate of 32%. If you include Teleperformance's recent acquisition of Majorel their revenues increase to over US$10 billion.

Teleperformance has a market share in the customer experience outsourcing industry of just under 10%. Some other major players in the customer experience outsourcing industry include: Concentrix, Foundever, Telus International and TTEC.

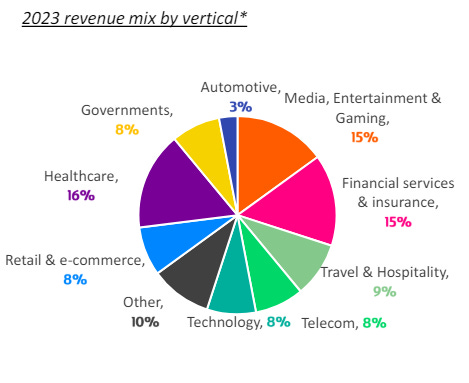

Demand for outsourcing customer experience spans from large multinationals to mid-sized firms, each seeking a market-specific approach to customer service. The industry is also becoming increasingly digitised, with the non-voice segment (accounting for 29% of revenues as of 2023) experiencing the fastest growth. Additionally, new disruptive 'tech' solutions are frequently emerging. Multidisciplinary firms from the business process outsourcing sector have begun entering the market, distinguishing themselves from traditional customer experience firms by focusing on high value-enhancing services rather than merely labour cost arbitrage.

Future Prospects for Teleperformance

Teleperformance has multiple sources of growth in this industry including underlying growth in demand for customer experience, increase in the rate of customer experience outsourcing and expanding market share. In the past it has focused on all three areas to expand its business, growing with its existing customers, taking on new customers in areas it is familiar with, as well as increasing its experience in new areas of customer experience. It has done this organically as well as through acquisition, expanding into many of the areas of its Specialised Services division.

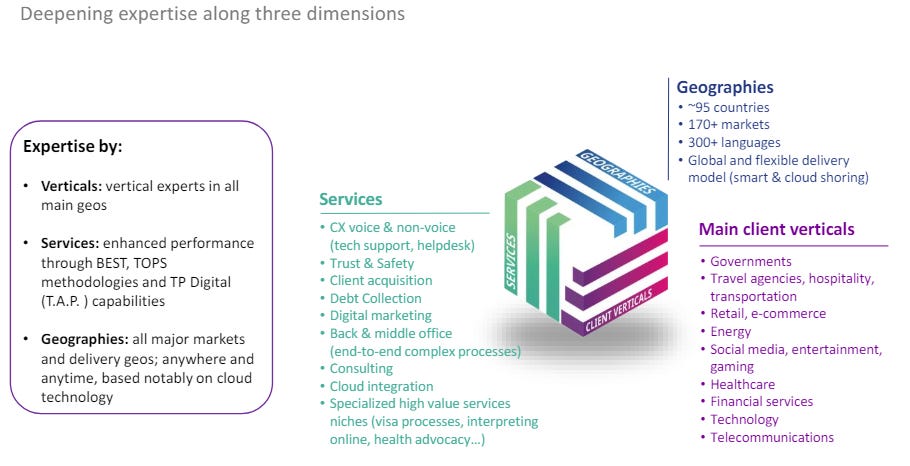

Teleperformance strategy for expanding into new adject areas is known as its “Cube” strategy because it deepens its expertise along 3 dimensions:

i) Build deeper skills and expertise in an adjacent area through acquisition or investment

ii) Use existing expertise and resources to improve on services in new area

iii) Apply skills and expertise in new area and new skills and expertise to existing clients and geographies

Balance Sheet

As of November 2021 Teleperformance was rated BBB by S&P with a stable outlook. Teleperformance level of debt has reached a peak of 2.2 times EBITDA in 2023 after its takeover of Majorel at 4.553 Billion Euros. This debt carries an average rate of 3.27%, 72% of it is fixed with an average maturity of 3.75 years.

Although Teleperformance debt has never reached these absolute levels it has reached these levels relative to EBITDA and through a mix of repayments and growth Teleperformance has reduced it.

Management Team

Daniel Julien: is the Chairman and Chief Executive Officer (CEO) of Teleperformance. Daniel founded Teleperformance in 1978 in Paris with only ten people and since then has led the company over the past 46 years. Daniel owns 1,246,980 shares in Teleperformance.

Bhupender Singh: is the Deputy CEO, CEO of Core Services and President of Transformation. Bhupender began working at Teleperformance in 2018 when the company he was CEO of Intelenet Global Services was taken over by Teleperformance. Bhupender has also worked for prominent consulting firms such as McKinsey and Booz Allen Hamilton. Bhupender owns 37,000 shares in Teleperformance.

Olivier Rigaudy: is the Deputy CEO and Group Chief Financial Officer (CFO). Olivier began working at Teleperformance as CFO in February 2010 and was appointed Deputy CEO in October 2017. Prior to his role at Teleperformance Olivier was the corporate secretary at Conforama and CFO of Castorama (Kingfisher) group before that. Olivier owns 147,500 Teleperformance shares.

Agustin Grisanti: Agustin is the CEO of Core Services. Prior to his current role Agustin was Teleperformance president of Ibero-LATAM , he joined Teleperformance in 2004. Agustin prior to working for Teleperformance worked in management consulting for firms such as Hermes Management Consulting and Anderson Consulting (Accenture).

Scott Klein: is CEO of Specialised Services. Before its acquisition by Teleperformance Scott served as CEO of LanguageLine. Scott has successfully led companies in multiple industries including: advertising, consumer packaged goods, market research and business process outsourcing.

João Cardoso: is the Chief Innovation and Digital Officer. João joined Teleperformance in 2003 and before coming into his current role was president for EMEA. Prior to joining Teleperformance João was one of the founders of Altitude Software (originally EasyPhone).

Teleperformance Valuation

Historically Teleperformance has generally traded with a premium valuation, with an average PE ratio prior to 2020 of 29. It spiked in 2019 so if that number is removed and we take the 5 years prior to 2019 it is 26. But at the moment Teleperformance is trading at a PE ratio of just over 10, two and a half times lower than in previous years.

If I run a Discounted cash flow model using

Best case: historic growth rates prior to covid as a best case scenario where for the next five years Teleperformance grows at 14% followed by 5%,

Base Case: With lower than historic growth rates where they grow at 11% followed by 4% and

Worst case: Where they grow at 5% followed by 0%.

All cases assume Teleperformance doesn’t return to its premium valuation.

I get a value of 214 Euros, about 106% higher than the current price. This also seems conservative relative to Teleperformance's historic valuation, if it were at this value its PE ratio would be 21, well below its historic PE ratio. So relative to historic valuation metrics and relative to below historic growth rates in a still highly fragmented and above average growth industry Teleperformance is really cheap.

In order to get the same value in my Discounted Cash Flow model as Teleperformance currently has I have to assume Teleperformance has a growth rate of 2% over the next 5 years followed by 0 into perpetuity. So after inflation the market is assuming Teleperformance will be shrinking from now on based on its valuation and so is a business in decline with only one year's declining earnings as evidence.

Risks for Teleperformance

Like all businesses Teleperformance business is subject to risks over the course of doing business some of these include:

Strategic Risks

Geographic presence: Teleperformance operates globally, exposing it to risks such as geopolitical tensions, macroeconomic volatility, and natural disasters. The company carefully assesses these risks when investing in new markets, ensuring potential rewards outweigh costs. Its broad geographical footprint and strong remote work infrastructure enable operational continuity and backup solutions. While geopolitical events like the Russia-Ukraine conflict have had minimal financial impact, the company actively manages inflation risks through client portfolio adjustments and contractual clauses. Additionally, Teleperformance has adopted an ambitious climate strategy with greenhouse gas reduction targets endorsed by the Science-Based Targets initiative to address environmental risks

Technology: As previously discussed regarding AI disruption, Teleperformance faces rapid technological evolution across its markets. The company must continuously adapt to meet clients' needs and anticipate future innovations to make necessary investments. Teleperformance could also be negatively affected if any of its technological services, such as the content moderation business in Colombia in 2022, are perceived poorly. To stay ahead, Teleperformance invests in new technological solutions, developing customer relations solutions, advisory services, data analysis offerings, and integrated digital solutions. Its expertise, scale, and industry specific data facilitate the creation and implementation of these solutions. Recognition at the European Contact Center & Customer Service Awards in 2023 and partnerships with dominant US digital market groups highlight its leadership. Notably, the TP GenAI suite launched in June 2023 enhances customer experience management with AI-powered solutions. Teleperformance also promotes transparency and understanding of its high-tech approach through investor events, demonstrating its integration of AI and commitment to employee wellbeing in new business areas like content moderation.

Competition: Teleperformance is a global leader in digitally integrated business services, but it operates in a highly competitive environment. The company faces challenges from both international and domestic players across various sectors, including consulting, IT services, digital transformation, and specialised contact centre management firms. To stay ahead, Teleperformance must continuously enhance its services and may need to adjust prices. The company's strategy includes a strengthened management structure and a high-tech, high-touch approach that offers a broad range of business services. Teleperformance also strategically acquires other companies to enhance its service offerings, as seen with its acquisition of Majorel in November 2023. This acquisition expanded its market presence in Europe and other key sectors, helping Teleperformance reach its €10 billion revenue target two years ahead of schedule. With around 410,000 employees, Teleperformance continues to reinforce its global leadership.

Acquisitions: Acquisitions are integral to Teleperformance's strategy for expanding its service offerings and venturing into high-growth sectors. However, they entail various risks, including identifying suitable targets and negotiating favourable terms, as well as integrating the acquired companies. Despite these challenges, Teleperformance has a successful track record in managing acquisitions, employing a rigorous process that includes thorough due diligence and meticulous planning for integration. For instance, the recent acquisition of Majorel in November 2023 is part of Teleperformance's broader growth strategy. The company has established procedures for evaluating potential acquisitions and implementing integration plans to achieve synergies. Notably, the involvement of former Majorel shareholders in Teleperformance's board underscores their commitment to the integration's success. Through its structured approach and experience, Teleperformance mitigates risks associated with acquisitions while capitalising on opportunities for growth.

Operational Risks

Employees: Teleperformance relies heavily on its workforce of 410,000 to deliver quality services to clients. The company's ability to attract, retain, and train competent employees directly impacts its service quality and client satisfaction. Ensuring fair treatment and professional development opportunities is crucial for maintaining a strong workforce. Teleperformance has established global teams dedicated to enhancing employee engagement and well-being, aligning with its high-tech, high-touch strategy. Moreover, the company prioritises employee safety, implementing measures based on World Health Organization guidelines. These efforts have led to Teleperformance receiving certifications such as Great Place to Work in 72 of its 99 countries, underscoring its commitment to employee satisfaction. Additionally, the company has implemented succession planning and non-compete clauses for key executives to protect its interests and maintain leadership continuity.

Information Technology Failure and Cybercrime: Teleperformance relies heavily on various information technology platforms to deliver its services. Unfortunately, these platforms are prime targets for cybercriminals, who exploit vulnerabilities to commit fraud and data theft, often demanding ransom. Tactics such as social engineering and exploiting third-party software vulnerabilities pose significant risks to the company. With the increasing number of employees working remotely, the threat landscape has expanded, leading to potential data breaches or service interruptions. Teleperformance has established robust measures to mitigate these risks, including stringent compliance with data security and privacy standards, regular operational assessments, and backup procedures. The company also invests in cutting-edge cybersecurity tools and shares threat intelligence with clients and industry peers. The recent acquisition of Majorel necessitates a comprehensive plan to align its information security practices with Teleperformance's standards.

Campaigns and/or Negative Images In the Media: Teleperformance faces potential defamation or unfounded accusations via social and traditional media platforms, which could harm its reputation. To address this, the company employs an external agency to monitor media and social channels, authorises designated senior managers to represent it publicly, and has a robust crisis management plan in place. In response to significant criticisms, localised crisis protocols can be activated, alongside organised events like open days and site visits, allowing investors and media representatives to directly observe company operations.

Client Portfolio Risk: Teleperformance's business success is contingent upon securing and retaining contracts with a diverse client base. Adjustments to contract terms, including pricing, requested by clients can impact Teleperformance's margins, especially during inflationary periods. Economic downturns or other factors leading to a decline in client volumes pose significant risks to Teleperformance's business and earnings, particularly if a client represents a substantial portion of its revenue. However, the company mitigates these risks through strategies such as maintaining a diversified client portfolio across regions, sectors, and service lines, as well as fostering long-standing client relationships, with an average tenure of 14 years. Teleperformance monitors client satisfaction throughout contracts to mitigate the risk of contract termination.

Legal and Regulatory Risks

Data Privacy: Teleperformance operates within a data-sensitive environment, handling both employee and client information, necessitating adherence to numerous statutory and contractual data security requirements to avoid adverse performance outcomes. To mitigate these risks, the company has established Global Information Security Policies (GISPs), implemented compliance audits, and convened the Global Compliance and Security Council quarterly. Additionally, a Global Privacy and Compliance Office oversees the implementation of a global policy for privacy and regulatory compliance. Teleperformance also maintains a Global Technology, Privacy, and Security Committee to evaluate new technologies and resolve cybersecurity issues. With certifications including ISO 27701 and Binding Corporate Rules (BCRs), Teleperformance ensures global data transfer and processing compliance.

Litigation and Employee Disputes: Teleperformance faces potential legal and regulatory challenges, including litigation and employee conflicts, across its operational jurisdictions. These risks arise from possible breaches of local laws or regulations, legal actions involving clients or external parties, and internal disputes among employees, especially during organisational changes. To address these risks, Teleperformance adheres to both local and international regulations, monitors legal developments through its network of in-house and external legal experts, and ensures employee engagement through consultation mechanisms. Provisions are in place to mitigate known risks and disputes.

Ethics, Corruption, and Human Rights Risk: Teleperformance, operating across 99 countries can result in potential ethical lapses, human rights violations, and corruption from employees or third parties. To mitigate these risks, Teleperformance maintains a zero-tolerance policy against corruption, outlined in its Code of Conduct and aligned with the United Nations Global Compact principles. This commitment extends to suppliers through the Supplier Code of Conduct. Additionally, in compliance with the French Sapin II law, Teleperformance has implemented a global anti-corruption program overseen by the Group Legal and Compliance Department. This program aims to prevent, detect, and respond to corrupt practices. Teleperformance's dedication to ethical business practices is evident throughout its organisational structure and emphasised in its annual reports.

Financial Risks

Foreign Exchange Risk: Teleperformance is exposed to foreign exchange risk as revenues are denominated in multiple currencies. This may come about due to appreciation in currencies costs are denominated, depreciation in currencies revenues are denominated or appreciation in currencies debts are denominated. Teleperformance has a hedging program for some of the currencies it deals with, especially currencies involving significant borrowing.

Interest Rate Risk: Teleperformance is exposed to interest rate risk on its debts as well as cash holdings. To protect against interest rate changes on its debt Teleperformance has 72% of its debt at fixed rates. Teleperformance also has the best credit rating in the customer experience outsourcing industry of BBB from Standard and Poor’s.

Credit Risk: Teleperformance is exposed to credit risk which is the risk of financial loss in the event a client or counterparty to a financial contract fails to meet their contractual obligations. This exposure is mainly concentrated in credit risk to clients. Credit risk is continuously monitored by the Group Finance Department through monthly reports and quarterly management meetings.

Liquidity risk: Teleperformance is exposed to liquidity risk, which is the risk of difficulty settling its liabilities as they fall due. This could be made worse by events going on in the world such as a major economic crisis, pandemic or other unforeseen fluctuation in cash flows. Teleperformance has a policy of always maintaining sufficient cash to meet all short term liabilities. All medium and long term financial arrangements are authorised and overseen by the Group Financial Department. Standard and Poor’s has confirmed the Teleperformance credit rating of BBB.

Conclusions

Teleperformance has a history of outperformance in its industry generating strong returns on capital, industry leading margins and growth rates. As a result it has historically traded at a premium valuation being recognised as a premium company.

Over the past year, there has been a not unprecedented decline in Teleperformance's results. This dip in results has led to a disproportionately large drop in the stock price, transitioning Teleperformance from a stock with a valuation premium to one with a valuation implying the whole business is in decline. Among investors, a prevailing theory suggests that the emergence of generative AI poses a substantial threat to Teleperformance. While the article explores this potential scenario, acknowledging current limitations, the article concludes AI is unlikely to entirely replace humans. In addition, Teleperformance is in a great position to capitalise on AI and other technologies.

If you foresee a scenario within the next decade where AI tools, including generative AI, surpass human communication abilities with other humans across various customer experience domains without human intervention, then Teleperformance may be considered overvalued.

Conversely, if you anticipate that human expertise and data will remain crucial in certain areas, and believe that Teleperformance can continue to leverage AI and other technologies to enhance client services' efficiency and quality, then Teleperformance could be significantly undervalued.

I am long Teleperformance at a slightly higher value than where it is today.

Hi Christopher, I just came across your entry and TP and found it an interesting read. I agree with a lot of your points but am not so sure about the angle that AI is an enabler of these CX / BPO firms to move up the value chain. I mean I'm not so sure how true that is and it's hard to tell from actual data right now.

I'm curious what you think of TP today given all the advancements in AI agents since you wrote this. Also, do you think your thesis would apply to the smaller CX firms on that list like TTEC (which btw has a buyout offer from its founder)?