Disclaimer:

The information provided in this Substack is for informational and educational purposes only and does not constitute financial product advice, investment advice, or a recommendation to buy, sell, or hold any financial products. The content is general in nature and does not take into account your personal financial objectives, situation, or needs.

While reasonable efforts are made to ensure the accuracy, completeness, and reliability of the information presented, no representation or warranty, express or implied, is given as to its accuracy or completeness. All opinions expressed are those of the author and are subject to change without notice.

I am not a licensed financial adviser. You should consult a licensed financial adviser, tax professional, or legal advisor before making any investment decisions. Investing involves risk, including the potential loss of capital, and past performance is not indicative of future results.

The author may hold positions in the securities mentioned and will disclose such holdings where relevant. Any mention of specific securities, investments, or strategies should not be interpreted as a recommendation.

By accessing and reading this content, you acknowledge and agree that the author is not liable for any loss or damage arising from any decisions you make based on the information provided. You are solely responsible for your own investment research and decisions.

I hold a position in Evolution.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Warren Buffett

Executive Summary

Evolution AB is a leading B2B provider specialising in live casino and Random Number Generator (RNG) games. Its wonderful business model boasts high profit margins, impressive returns on capital, and robust growth rates. Over the past decade, Evolution has achieved a remarkable compound annual growth rate (CAGR) exceeding 50%, with profit margins surpassing 60%. Despite its high-quality operations, the company's valuation has recently been fair to low, presenting investors with an attractive entry point.

The rapid growth of Evolution is driven by the emerging nature of its market, as live gaming continues to gain legalisation and regulation worldwide. However, this dynamic environment also introduces risks, as regulatory, legal frameworks and industry standards are still evolving. The primary risk facing Evolution is regulatory changes, which could significantly impact its operations. Additionally, the presence of grey markets—where live gambling is neither fully legal nor regulated—poses another challenge for the company.

What Does Evolution Do?

Evolution AB is a leading B2B provider of innovative online casino games, which can be categorised into two main segments:

Live Casino Games

Evolution offers a comprehensive range of live casino games that are streamed in real-time over the internet, providing players with an authentic casino experience. Key features include:

Authentic Atmosphere: Designed to replicate the ambiance of a physical casino, these games offer unique experiences that are only possible through live streaming.

Interactive Social Experience: Real human dealers who are filmed in real time and streamed live to players, who can chat not only with the dealer but each other creating a more social online gaming experience.

Real Time Play: Game results are determined live, with dealers conducting activities such as spinning wheels, rolling dice, or dealing cards.

Diverse Game Selection: Evolution's portfolio includes classic casino games like roulette, blackjack, and baccarat, as well as exclusive titles like Crazy Time and Lightning Roulette.

Random Number Generator (RNG) Games

These games rely on algorithms to determine outcomes, offering instant play without human involvement. Evolution's RNG offerings include.

Diverse Game Selection: There are a wide variety of such games including: Blackjack, Slots, Roulette and Taco Fury XXXtreme.

Revenue Model

Evolution generates revenue through a mix of fixed and variable payments from over 800 clients as of 2023. The majority of its income comes from commissions, calculated as a percentage of the profits generated by its clients from Evolution's online games.

Market Presence

In 2023, live casino games accounted for approximately $1.5 billion in revenue (85%), while RNG games contributed around $275 million (15%). Although founded in Europe, Evolution now derives most of its revenue from markets outside Europe, with Asia being its fastest-growing region.

About 40% of Evolutions revenues comes from regulated markets, where online gambling is explicitly legal and regulated. The other 60% of revenues come from unregulated markets, these are markets where governments have not explicitly legalised or prohibited online gambling and are known as grey markets.

Evolutions Moat

Evolution AB's Chief Product Officer, Todd Haushalter, once remarked that live casino games have "low barriers to entry, high barriers to success." However, I contend that the barriers to entry are indeed high, with even greater challenges to achieving success. These barriers encompass not only the creation of profitable games but also the delivery of these games to clients. Evolution has operated in Europe since its founding in 2006 and none of its European clients have ever tried to run their own live games.

Scale

A key component of Evolution's moat is its scale. With a vast customer base, Evolution can distribute its fixed costs across a large number of players. Unlike traditional casinos, live games hosted by Evolution can accommodate virtually unlimited players, as the games are streamed online rather than confined to physical tables. This scalability reduces the per-player cost of operations, such as dealer salaries and studio expenses, as more players join.

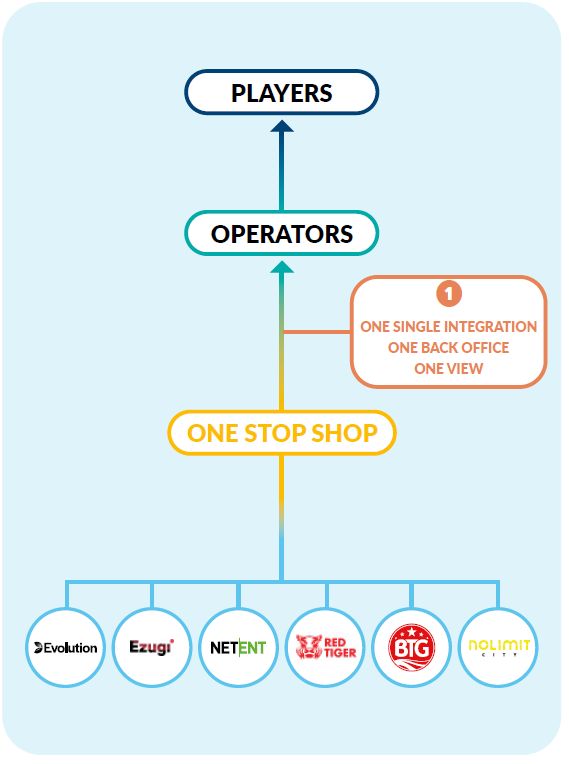

Moreover, Evolution's extensive scale enables it to offer a broad array of games and tools, such as its One Stop Shop (OSS), which smaller competitors cannot financially justify. This scale also allows Evolution to invest heavily in research and development (R&D), using data from its large player base to optimise game design and functionality. For instance, Evolution funds a team to test its games on the top fifty devices used by players, ensuring a seamless gaming experience that smaller competitors cannot match.

Experience

Since its inception in 2006, Evolution has amassed significant experience across diverse markets, allowing it to address and resolve various operational challenges. The company has developed robust solutions to tackle issues such as cybersecurity threats, problem gambling, player cheating, and dealer errors. Evolution's training programs for dealers are informed by this extensive experience, ensuring efficiency and minimising costly mistakes despite high staff turnover.

Additionally, Evolution leverages its long-standing presence and data-driven insights and testing to optimise its games and player interactions. By analysing player behaviour and chat histories, Evolution can refine game elements and monitor for potential issues This can be seen in its monitoring of problem gambling, using advanced machine learning models.

Regulation

Regulation serves as both an advantage and a challenge for Evolution. The stringent regulatory environment creates high barriers to entry, as new entrants must navigate complex legal requirements and establish systems to prevent fraud and money laundering. Evolution's established presence in multiple markets allows it to spread these regulatory costs across a broad customer base, as well as take solutions from one market to another providing a competitive edge.

Furthermore, Evolution's proven compliance with regulations in existing markets facilitates entry into new regions, as it can demonstrate effective systems and processes to regulators. As Evolution continues to expand and refine its regulatory compliance, it strengthens its moat against potential competitors.

Thus as Evolution grows, experiments and develops greater systems to meet regulatory requirements Evolution widens the moat between it and any potential competitor.

Evolution's significant competitive advantages are most evident in its live casino segment, where it has consistently outpaced market growth. In contrast, its RNG segment has struggled to achieve similar organic growth, relying instead on acquisitions. Nevertheless, offering a comprehensive suite of live and RNG games enhances Evolution's value proposition to clients.

Below is the part of an interview with Chief Product Officer Todd Haushalter where he discusses Evolutions competitive advantage:

Earnings and Historical Overview

Founded in 2006 by Jens Von Bahr, Fredrik Österberg, and Richard Hadida, Evolution AB set out to create live casino games for European online gaming operators. By 2012, the company expanded into mobile gaming, and in 2013, it celebrated the opening of its 100th table at its Riga, Latvia studio. Over the subsequent years, Evolution established additional studios in Spain, Malta, and Belgium, along with engineering hubs in Estonia and the Netherlands. The company went public in 2015, listing on Nasdaq First North Premier, and later moved to Nasdaq Nordic in 2017. That same year, Evolution introduced the innovative game show category with "Dream Catcher."

In 2018, Evolution embarked on its first significant expansion beyond Europe, entering the Canadian market and forming partnerships with major U.S. clients in New Jersey.

Acquisitions

Ezugi (2018): Evolution acquired live casino games competitor Ezugi in 2018 for an initial price of €12 million, followed by a conditional €6 million if certain milestones are met. In the first year after the acquisition the deal was expected to add 2%-4% to revenues, which in 2019 were 365.75 million Euros. This would put Ezugi’s contribution to revenues at about 7-14 million Euros, putting its initial purchase price at 1-2 times revenues. If you generously assume when integrated into Evolution it achieved the same margins Evolution had a net margin of 40.94% in 2019 which would put Ezugi’s contribution to profit at 2.9 to 5.8 million Euros and so the PE at 2-4 times earnings. Ezugi seems like a good deal based on my limited knowledge, not even from an earnings perspective based on my generous assumptions. This is because at the time Evolution was expanding outside of Europe and Ezugi gave it access to its existing markets, clients, studios and regulatory relationships in South Africa, Latin America and the USA.

In order to improve its RNG games offering and gain the ability to offer clients a full service offering of online games Evolution has also in recent years acquired a number of RNG games companies.

NetEnt (2020): In 2020 NetEnt was bought for about €1.9 billion, which itself had recently acquired RedTiger, another RNG games provider. It was to be paid for in shares of Evolution at an exchange ratio of 0.1306 Evolution shares for each NetEnt share, representing a 43% premium as at the 23rd of June 2020. At the time of the takeover NetEnt had a revenue of 174.88 million Euros and an adjusted EBITDA of 82.75 million. So Evolution paid nearly 11 times earnings or 23.5 times EBITDA. This acquisition seems much more expensive than Evolutions acquisition of Ezugi. The only way such a high premium can be justified was that at the time Evolution’s shares were trading at a much higher premium in 2020 of 29.9 times revenue or 56.44 times EV/EBITDA. This means the shares NetEnt shareholders were paid with stock that was even more expensive than the premiums paid. So from that perspective it could be seen as not as bad, paying an overvaluation in overvalued currency.

DigiWheel (2021): This technology-focused acquisition involved an upfront payment of €1 million, with additional undisclosed earn-out payments. Although smaller in scale, the deal aimed to enhance Evolution's technological capabilities.

No Limit City (2022): Evolution acquired No Limit City It was an all cash deal with €200 million in all cash payments as well as an additional €140 million in performance related payments. Evolution said it expected revenue from No Limit City to reach €30 million in 2022 and EBITDA to reach around €23 million. This puts the valuation Evolution paid in cash at nearly 7 times revenues or just over 11 if you include bonus payments. As for EBITDA No Limit CIty had quite good EBITDA margins and so Evolution paid 9-15 times EBITDA, depending on whether you include bonus payments. This is cheaper than its purchase of NetEnt, although it was made in cash rather than in my view overvalued stock.

These takeovers have allowed Evolution to buy its way from a dominant leadership position in Live Casino into the much more competitive market of RNG games. Investors have expressed concerns about the amounts paid by Evolution for these companies, as well as the subsequent organic growth of this segment.

General Earnings

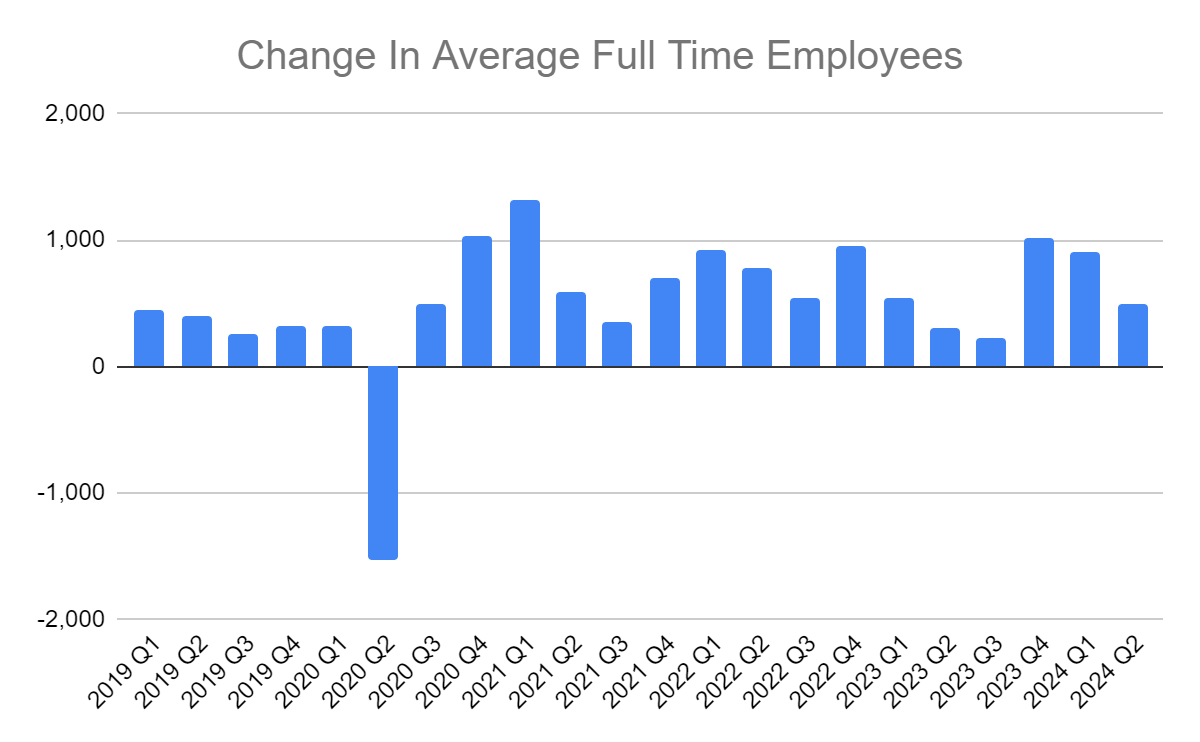

Overall over the last 10 years Evolution has thrived, growing its whole business and expand its margins with revenues growing at a Cumulative Annual Growth Rate (CAGR) of 43.5% and Net Income growing at a CAGR of 56.6%.

Earnings per share have grown at equally impressive rates of 53.5%

Evolution's margins and EPS growth have slowed, likely due to the natural deceleration of a rapidly expanding company, alongside some one-off factors.

i) Over most of Evolution’s history it has channeled the majority of its earnings through low tax jurisdictions such as Malta paying an effective tax rate of 6.8% in 2023. However over the past year the long awaited pillar II has been introduced subjecting Evolution to a minimum tax rate it estimates at 15.2%, marking a substantial increase in its tax obligations.. This tax hike is expected to reduce Evolution's profit margins, representing a one-time adjustment rather than an indication of a broader industry decline.

ii) As part of its expansion efforts, Evolution AB has been actively hiring and training a significant number of new employees. Initially, these new hires are less productive than their more experienced counterparts due to the necessary training and mentorship periods. Additionally, many of these employees are based in North America, where regulatory requirements stipulate that some must be employed in the states where they operate. Unlike other regions where Evolution can establish studios in countries with lower wage costs and attract players from multiple countries to the same tables, North American regulations often mandate that tables be located within specific states. This results in higher labour costs and fewer players per table, which can lead to lower profit margins in these markets. The general expense of hiring new employees is a one off cost of growth hit to Evolutions margins, while its growth in the USA represents lower margin growth, but still growth in EPS nonetheless.

In its latest quarterly update, Evolution announced a new capital allocation framework. Since its 2015 IPO, the company has aimed to return at least 50% of profits to shareholders through dividends. With excess cash remaining after investments, dividends, and M&A activities, the board has decided to return 100% of this surplus to shareholders, primarily via buybacks, and occasionally through dividends when deemed more value enhancing for shareholders.

Online Gaming Industry

According to H2 Gambling Capital, the global gambling market, encompassing both land-based and online gambling, generated approximately €489 billion in revenue in 2023. Land-based casinos, lotteries, and gaming machines accounted for roughly 75% of this total revenue.

The online gambling sector, being relatively new and increasingly regulated, has experienced rapid growth compared to the broader gambling market. Between 2019 and 2023, the online segment expanded at a compound annual growth rate (CAGR) of 20%, while the overall gambling market grew at a CAGR of 4.6%. Within the online space, live casino games emerged as the fastest-growing segment, achieving a CAGR of 24% during the same period.

The COVID-19 pandemic significantly boosted the online gambling market over the past five years, as more consumers turned to digital platforms for entertainment. However, future growth rates are expected to moderate as the market stabilises post-pandemic.

Future Prospects for Evolution

The future prospects for Evolution AB appear promising, although being part of a rapidly expanding industry comes with inherent risks

The online gambling market is projected to grow at a low to mid-teen percentage rate over the next five years. This growth is driven by several factors, including the increasing regulation and legislation of online gambling and live casino games in new markets, as well as the expanding market share of online gambling within these regions. Currently, 60% of Evolution's revenue is derived from unregulated markets. Regulation in these areas could encourage greater investment by online casinos and offer enhanced player protection and rights, potentially boosting player engagement. Despite online gambling's current global market share of 25%, it reaches 35% in mature European markets. Online platforms could potentially dominate over time even more of the market by offering greater accessibility to individuals located far from physical casinos or other land-based gambling venues.

Evolution operates in the rapidly growing segment of live casino games and has historically outpaced market growth. Unlike the more established RNG market, the live casino segment has been a "winner-takes-most" market, with Evolution as the leading player. The company consistently grows faster than the market, generates higher margins than competitors, and produces more award-winning and popular games. Evolution supports this growth by enhancing its offerings with advanced tools for clients, such as the One Stop Shop (OSS) platform. This platform provides clients with instant access to Evolution's games, reducing time to market and offering a unified interface.

Regulation poses a potential challenge for the online gambling industry. There is a risk of issues such as compulsive gambling or fraud prompting government intervention. However, most jurisdictions have opted for increased regulation rather than shutdowns, not wanting to drive this industry underground. Another scenario is that governments may seek a larger share of industry profits through regulatory measures. While all forms of regulated gambling contribute to tax revenue, land-based casinos also generate jobs in related sectors like hospitality and tourism. Consequently, the potential shutdown of online gambling poses less of a loss to governments and their constituents compared to land-based casinos.

Lastly, the possibility of market disruption remains. Despite Evolution's strong competitive advantages, particularly in live casino games, there is always a chance that a new provider could introduce innovative games or gambling formats that challenge Evolution's position. Given the rapid pace of digital technology development, Evolution must remain vigilant to avoid missing key technological advancements that could shape the industry's future. A small-scale example is the success of the online game Aviator, developed by the relatively small company Ejaw, which gained popularity and outperformed established industry players. Although Aviator was in the much more competitive RNG gaming segment, as I have argued, Live Casino is much more difficult to enter and constitutes the majority of Evolutions revenues.

Competitors of Evolution

Many of Evolution AB's competitors are private companies, making detailed information about them less accessible. Some of Evolutions competitors include:

Playtech: is a competitor to Evolution, although it has taken a more diversified approach by offering a wide range of online casino software and services. These include online casinos, poker rooms, sports betting, live casino, and mobile gaming. In 2023, Playtech generated approximately €1.7 billion in revenue, slightly less than Evolution. However, Playtech's net margins are significantly lower, at around 7%, and it does not consistently achieve profitability. Unlike Evolution, which dominates the live casino market, Playtech spreads its focus across multiple areas, including both B2C and B2B segments.

Pragmatic Play: is a leading provider of online slots (RNG games) and also offers live casino services, bingo, and virtual sports. As a private company, detailed financial information is limited, but it is recognized for its strong presence in the RNG market.

Authentic Gaming: is another private competitor, specialising in live casino software and services. It streams games from both land-based casinos and studios and has a presence on over 200 online operator sites with a workforce of more than 300 employees.

Balance Sheet

Evolution AB maintains a robust financial position with minimal debt, as most of its operating expenses and capital expenditures are efficiently covered by the cash generated from its operations. The company’s high returns on capital reduce the necessity for significant borrowing.

Like many large corporations, Evolution carries some lease liabilities, tax obligations, and other liabilities. However, these are well-managed and comfortably covered by the company's available cash reserves. This prudent financial management supports Evolution's ability to invest in growth opportunities while maintaining financial stability, as well as rewarding shareholders.

Management Team

Martin Carlsund: is the current Chief Executive Officer (CEO) of Evolution. Before his tenure at Evolution, he served as CEO for Highlight Media Group, Eniro Sverige, Eniro Finland, and 3L Systems. He has been employed by the group since 2015 and holds 684,710 shares of Evolution.

Todd Haushalter: is the Chief Product Officer and Games Operations. He previously held the position of Vice President of Gaming Operations at MGM Resorts and has extensive experience in casino game development and operations. He has been at the group since 2015 and owns 96,300 shares of Evolution.

Jacob Kaplan: Is the Chief Financial Officer (CFO) at Evolution. His previous roles include CFO at Nordnet AB and Vice President, Finance Director at Nasdaq OMX Transaction Services Nordics. He has been employed by Evolution since 2016 and owns 60,000 shares in Evolution.

Sebastian Johannisson: is the Chief Strategy Officer at Evolution. He has previously served as Chief Commercial Officer and Head of Account Management. He has been working for Evolution since 2008 and owns 700,000 shares.

Louise Wiwen-Nilsson: is the Chief Human Resource Officer at Evolution. Louise has previously held leading human resource positions within Viacom/MTV, Nike and Walt Disney. She has been employed by Evolution since 2016 and owns 22,780 shares.

Jens Von Bahr: As the Chairman of the Board and one of Evolution's founders, Jens Von Bahr has been with the company since its inception in 2006. Before founding Evolution, he was the managing director of Oriflame Sri Lanka and has founded several companies. Von Bahr owns 22,400,140 shares in Evolution.

Overall Evolution insiders own about 14.8% of the company with members of the executive team having significant amounts of their wealth tied to the business.

Valuation

Over the past year, Evolution AB's stock price has fluctuated from fair to undervalued levels. Its price-to-earnings (P/E) ratio has averaged 34 over the past five years, peaking at 57 in 2020 and currently standing at 17.

To assess Evolution's valuation, I conducted a Discounted Cash Flow (DCF) analysis using different scenarios:

Base Case: This scenario assumes a 15% growth rate for the next five years, followed by 10% growth for the subsequent five years, before stabilising at average market growth. It includes a 55% payout ratio and a final P/E ratio of 16 after ten years. This conservative estimate reflects Evolution's historical mid-double-digit growth rates, moving to low double digit and its status as a high-quality business with strong margins and returns on capital, which typically command a premium valuation.

Optimistic Case: This scenario projects a 25% growth rate over the next five years, followed by 15% growth in the subsequent five years, with a 75% payout ratio and a final P/E ratio of 18. Despite being a best-case scenario, it remains conservative given Evolution's past performance. The payout ratio considers both dividends and share buybacks, supported by the company's robust free cash flow generation.

Pessimistic Case: This scenario assumes a 10% growth rate for the first five years, followed by 3% growth in the following five years, with a 50% payout ratio and a final P/E ratio of 12.

When running a DCF with these conservative assumptions the final result comes out to 1,842 SEK. This puts Evolution at a current discount of about 45% given its current price of 1,006.5 SEK.

If we reverse-engineer the DCF to determine what growth assumptions would justify Evolution's current share price, we would need to assume a 12% growth rate for the first five years, followed by a 5% growth rate, and a final P/E ratio of 13. Given the historical popularity and market share of live casino games, such a scenario seems unlikely unless there is a significant regulatory shift, such as a coordinated global crackdown on online casinos, which remains improbable as there is currently no reason and would be difficult to coordinate.

Risks for Evolutions Investment Case

Investing in Evolution AB comes with a number of risks, especially given the rapid growth and evolving nature of the online gambling industry, which is still establishing its long-term structure and societal impact.

Some of these risks include:

Regulatory

As a player in the heavily regulated gambling industry, Evolution faces complex and inconsistent laws across jurisdictions. Both Evolution and its online casino clients are subject to stringent regulations and higher taxes compared to other businesses. The company must maintain various licences and certifications, and any revocation or unfavourable renewal could drive customers to competitors. Additionally, Evolution must comply with a range of gaming laws, including anti-money laundering, market abuse, data protection, and privacy regulations. Compliance is costly and complex, and any failure, even accidental, could negatively impact the company’s operations and financial performance.

Regulations can impose significant fixed costs in each market, potentially reducing margins. For example, U.S. regulations requiring state-specific studios can limit economies of scale. Moreover, increased taxes could reduce the revenue share available to Evolution and its clients. Governments may also favour land-based casinos due to the broader economic benefits they provide, such as job creation in associated industries like hospitality and retail.

Regulated vs Grey Markets

Over 60% of Evolution's revenues come from 'grey markets,' where live casino gaming is not explicitly regulated. If governments decide to regulate these markets, they could impose bans, or unfavourable regulations. Even if these markets aren’t regulated, unfavourable interpretations of existing laws pose a risk to Evolution’s revenue streams.

Dependence on Major Customers

Despite Evolution's geographic diversification, 41% of its 2023 revenue came from its top five customers. This concentration risk means that any downturn in these customers' businesses or a shift to competitors could significantly affect Evolution's revenue and profitability.

Counterparty Risk

There is a risk that Evolution's customers may fail to meet their financial obligations. Although Evolution conducts thorough credit checks, changing market conditions could impact customers' ability to pay, especially in less stable markets.

Competition Pressures

The online gambling industry is highly competitive, with numerous new and growing competitors. Evolution must continue to innovate and strengthen its market-leading position to retain and attract customers. Failure to do so could result in a loss of market share.

Intellectual Property Risks

Protecting and enforcing intellectual property rights is crucial for Evolution's competitive edge. There is a risk of infringement claims, and defending these rights in court can be costly and, if unsuccessful, financially damaging.

Taxation

Evolution conducts its business through subsidiaries active in the geographic markets it operates. The business, including intra-Group transactions, is conducted in accordance with Evolution's interpretation of applicable tax laws, tax treaties and other regulations in the relevant countries. Although Evolution consults independent tax advisors, there is the risk that countries make decisions that deviate from Evolution's interpretation.

Recently Evolutions tax rate has been significantly increased from an estimated 6.8% in 2023 to more than 15% in 2024. This is due to the implementation of Pillar II, a global minimum tax initiative.

Geographic presence

Evolution has customers, studios and officers all over the world exposing it to the country specific risks of the countries it operates in. One potential risk in one of these countries is in the nation of Georgia, where Evolution has large studios and new laws being passed have led to significant protest and disruption in the country. In addition, the workers of Georgia have recently started forming a union and demanded better working conditions.

General Risk Management

Evolution is exposed to a variety of risks which need to be managed. In order to manage these identified risks the group applies procedures and internal controls. The Group Risk Committee meets on a quarterly basis to discuss and address potential risks. An example of this is the risk of money laundering or fraud Evolution is exposed to. Evolution has implemented internal control systems and established a primary mission control in Latvia that monitors transactions, volumes and patterns.

Conclusions

In conclusion, Evolution AB stands as a formidable player in the online gaming industry, leveraging its robust business model, high margins, and strong growth trajectory. The company has effectively capitalised on the expanding live casino market, outpacing industry growth with its innovative offerings and scalable operations. Despite facing regulatory challenges and market risks, Evolution's strategic positioning, coupled with its efficient use of capital and strong management team, provides a solid foundation for continued success.

The company's valuation is currently undervalued, presenting a compelling investment opportunity. Although Evolution is in an industry with higher risks, it is also a premium business so a P/E ratio of 17x as well as a conservative DCF show it is undervalued today.

Looking ahead, Evolution's focus on expanding its geographic reach and enhancing its product offerings positions it well to capture further market share. The company's commitment to innovation and customer engagement, alongside its disciplined approach to risk management, underscores its potential for long-term value creation. Investors should consider Evolution's strong competitive moat, growth prospects, and current valuation as key factors in their investment decision-making process.

How often can you buy a business that dominates a rapidly growing industry, has a history of mid double digit growth and pays a dividend over 3%, not including buybacks.

I own Evolution at an average price of 1,122 SEK

Thanks!

Quite the dive! Welll done.