Dicker Data: Quality Growth at a Reasonable Price?

Executive Summary

Dicker Data is a leading, founder-led distributor of Information and Communication Technology (ICT) products across Australia and New Zealand (ANZ). The company plays a critical role in the ICT supply chain, ensuring businesses have access to the latest productivity-enhancing technologies. Its unique corporate culture is shaped by long-tenured senior management, many of whom are significant shareholders and recent active buyers of the company’s stock.

While recent financial results have been underwhelming, driving a decline in the stock price, these issues are largely the result of short-term challenges rather than weaknesses in the company’s long-term fundamentals. Despite Dicker Data’s current valuation presenting historically favorable levels and the potential for above-average returns making it a buy in my view. But I believe there are currently other investment opportunities that offer better return prospects relative to their valuation and risk profiles and so won’t be increasing my position any more without a more favorable valuation.

What Does Dicker Data Do?

Dicker Data is a leading distributor of Information and Communication Technology (ICT) products and services, serving businesses across Australia and New Zealand (ANZ). The company operates as a vital link in the ICT supply chain by purchasing technology products from hundreds of global producers (vendors) including renowned brands such as NVIDIA, Microsoft, Fujitsu, Dell, and Assa Abloy, and then distributing these products to retailers and other businesses for resale or direct use (partners).

While this function may not seem glamorous, it is an essential service. Dicker Data facilitates the movement of ICT products from vendors to its partners, handling procurement, warehousing, and delivery throughout ANZ. By purchasing in bulk, the company reduces costs, which benefits both its suppliers and customers. Beyond logistics, Dicker Data adds value by providing tailored solutions for Small and Medium-sized Enterprises (SMEs), addressing challenges like computing, cybersecurity, networking, and surveillance—areas where these businesses often lack the scale for in-house expertise.

Revenue Breakdown by Segment

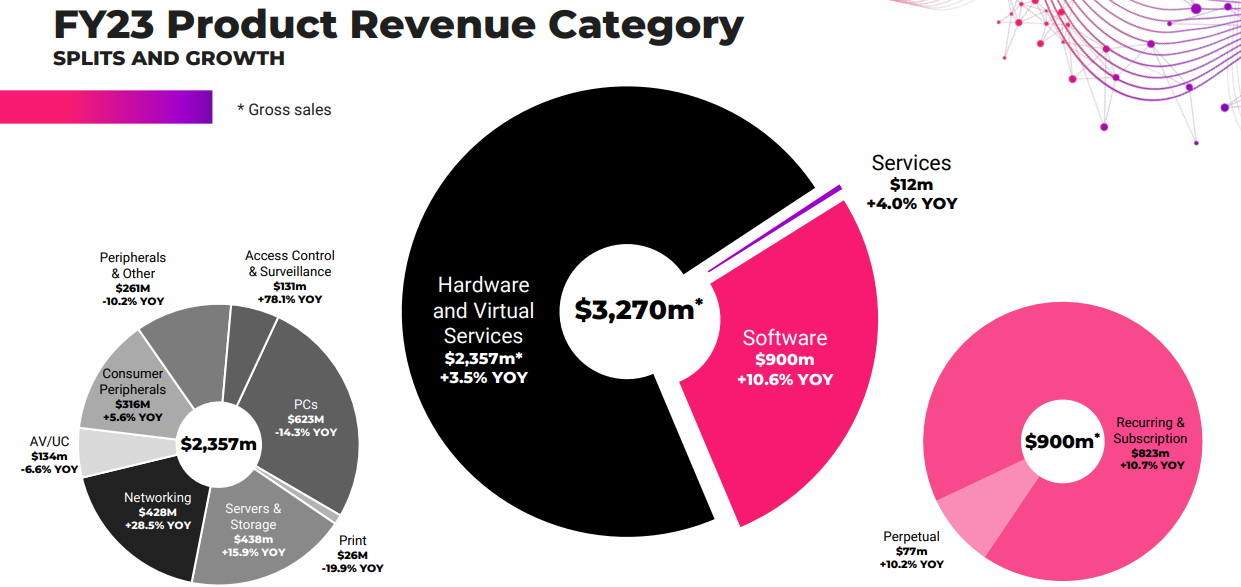

Dicker Data’s operations are divided into three core categories:

Hardware and Virtual Services:

Contributing approximately 72% of revenue, this segment includes products such as PCs, servers, storage solutions, networking equipment, and consumer peripherals.

Software:

Accounting for around 28% of revenue, this segment is split between recurring and subscription-based software and perpetual licenses.

Services:

Representing less than 0.4% of revenue, this segment includes additional support and consulting services.

By focusing on these areas, Dicker Data ensures that businesses in ANZ have access to cutting-edge technology and the support they need to stay competitive in a rapidly evolving market.

Does Dicker Data have a competitive advantage/moat?

Dicker Data’s investor relations material suggests that the company does not perceive itself as having a significant economic moat. In its 2023 annual report, the company states:

“In a highly competitive industry that does not provide for the development or maintenance of any economic moats, annual profit growth and, as a consequence, our dividends, is the primary driver of value.”

This statement implies that Dicker Data views its industry as inherently challenging for sustaining structural competitive advantages. However, achieving and maintaining its position as the largest distributor of ICT products in ANZ—especially when viewed through the lens of its financial performance—suggests that the company does hold some notable competitive advantages.

It’s also possible that management strategically downplays the existence of any moats. By emphasizing the role of leadership and operational excellence, they may seek to promote their own performance rather than drawing attention to the structural advantages Dicker Data may have developed, since the company was founded.

Paraphrasing Peter Thiel’s observation, companies with the strongest competitive moats often downplay their advantages to avoid attracting regulatory scrutiny. Conversely, businesses without significant moats tend to emphasize their supposed advantages, as they have less to lose from regulatory intervention. From this perspective, Dicker Data’s stance may be more about strategic positioning than a reflection of its actual competitive standing.

Supplier Relationships

As the largest ICT distributor in ANZ, Dicker Data uses its scale to secure significant purchasing volumes from global technology producers. This scale grants the company strong bargaining power, enabling it to negotiate favorable bulk discounts that benefit both its operations and its customers. For producers, partnering with Dicker Data offers access to an expansive and efficient sales channel, making the relationship mutually beneficial.

Operating since 1978, Dicker Data has built deep, long-term relationships with many of its suppliers. This extensive history fosters trust and collaboration while providing the company with unparalleled insights into the quality, reliability, and capabilities of the vendors products it distributes. These insights allow Dicker Data to offer tailored recommendations to its partners, helping businesses choose the right solutions for their needs.

By combining its purchasing power with decades of expertise, Dicker Data cements its position as a trusted and valuable partner in the ICT supply chain.

Economies of Scale

Managing relationships and delivering products from hundreds of vendors to thousands of partners is a complex challenge. Dicker Data effectively addresses this by leveraging economies of scale. The company invests heavily in infrastructure, logistics, and technology to build a highly efficient distribution network.

As Dicker Data grows and processes larger volumes of goods, certain costs—such as warehousing, transportation and software systems—benefit from scale efficiencies, even though they are not entirely fixed. Spreading these costs across a larger volume of sales helps reduce the per-unit cost of distribution. This reinforces its position as a cost-effective and reliable partner in the ICT distribution industry.

Unique Culture

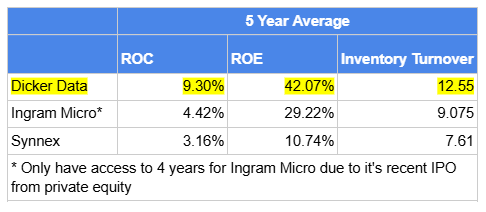

Dicker Data stands out as a well-managed company within ICT distribution with a distinct culture that has helped it outperform major competitors like Ingram Micro and Synnex.

Dicker Data was founded by David Dicker and Fiona Brown, and its culture evolved organically to align with the unique needs of the ANZ market. Unlike its competitors, the company has cultivated a leadership team with long tenures, fostering continuity and a deep understanding of the business. David Dicker’s philosophy of paying employees—particularly executives—above-market rates has been instrumental in attracting top talent and motivating them to perform at their best. Moreover, Dicker Data's focus on the SME market, rather than placing a greater emphasis on large enterprises like its competitors, has been a key differentiator.

These cultural factors have enabled the company to make smarter investments in infrastructure and talent, driving superior financial performance and delivering better returns. As a result, Dicker Data’s culture of employee investment and market specialization has allowed it to consistently outperform peers in a competitive industry.

Earnings and Historical Overview

Founded in 1978, Dicker Data has steadily grown to become a leading ICT distributor in ANZ. The company achieved a significant milestone in 2000 when its annual revenue surpassed $100 million—22 years after its inception. By 2011, Dicker Data went public, listing on the Australian Stock Exchange (ASX). The company’s growth trajectory accelerated, with revenue surpassing $1 billion for the first time in 2015 and then doubling to exceed $2 billion in 2020.

Dicker Data’s growth has been fueled not only by organic expansion but also through strategic acquisitions that have expanded its customer base, added new vendor relationships, and broadened its product offerings:

2014: Express Data Holdings Acquisition

Dicker Data acquired Express Data Holdings from Dimension Data, a Japanese systems integrator..2021: Exeed Acquisition

The acquisition of Exeed, a leading ICT distributor with a strong presence in New Zealand, elevated Dicker Data to the position of the second-largest ICT distributor in New Zealand. This deal also provided access to additional vendor partnerships.2022: Hills Security Acquisition

Dicker Data diversified its offerings by acquiring Hills Security, a distributor specializing in security products. This move leveraged the company’s expertise in distributing technical goods while enabling entry into complementary markets with synergies to its core ICT business.

Recent Earnings Volatility

In recent years, Dicker Data’s revenue and profits have experienced notable variability due to external factors:

COVID-19 Pandemic (2020–2021):

The pandemic drove a surge in demand for ICT products as businesses and workers transitioned to remote work. This period resulted in unprecedented revenue growth.Supply Chain Disruptions (2022):

Following the initial boom, profit margins were squeezed as Dicker Data adopted a strategy of stockpiling inventory to avoid disappointing customers amid global supply chain challenges and semiconductor shortages.Impact of Rising Interest Rates (2023):

Higher interest rates have recently affected Dicker Data, both by increasing its borrowing costs and dampening demand among its key SME customers.

Despite these temporary challenges, Dicker Data remains well-positioned for long-term success. The ongoing need for ANZ businesses to refresh and upgrade their ICT infrastructure underpins steady demand for the company’s products and services. While recent factors have impacted profitability, they are unlikely to diminish the company’s competitive strengths or its ability to generate value in the future.

Dicker Data’s Future Prospects

Australia and New Zealand are high-income countries with steadily growing populations, fostering a strong appetite for technological advancements that enhance workplace efficiency. As the leading ICT distributor across ANZ, Dicker Data is well-positioned to benefit from both short-term factors and long-term trends driving demand for technology solutions.

Short-Term Catalysts

A significant portion of Dicker Data’s customer base comprises Small and Medium-sized Enterprises (SMEs), which have been grappling with the challenges of rising interest rates in recent years. While the timing and extent of future rate reductions remain uncertain, these businesses will eventually need to refresh their ICT infrastructure, creating a pent-up demand for upgrades.

Another factor likely influencing ICT upgrades is the upcoming end of support for Windows 10, scheduled for October 14, 2025. The loss of support is expected to stimulate PC refresh cycles, a crucial revenue driver that accounted for 22% of Dicker Data’s sales in FY2024.

Generative AI and Cloud Adoption

The rapid evolution of generative artificial intelligence (AI) is creating new opportunities across industries. The demand for AI-ready computers and cloud solutions is accelerating as businesses seek tools to enhance productivity and innovation. Dicker Data stands to benefit as AI technologies, including specialized hardware and software, continue to gain traction.

Cybersecurity: A Growing Priority

Cybersecurity remains a critical concern for businesses, particularly SMEs, which often lack the expertise to navigate the ever-evolving threat landscape. Dicker Data offers tailored cybersecurity solutions that address these challenges, positioning itself as a reliable long-term partner for businesses seeking to protect their operations against sophisticated cyberattacks.

Collaboration Solutions: The Future of Work

The COVID-19 pandemic fueled a surge in demand for collaboration tools, enabling remote work on an unprecedented scale. As technology advances, these solutions are becoming even more valuable. Emerging features such as AI-generated meeting transcripts and real-time translation services are here or on the horizon, offering businesses new ways to boost productivity and foster global collaboration.

Long-Term Outlook

The combination of ongoing digital transformation, the evolving needs of SMEs, and advancements in technologies such as AI, cybersecurity, and collaboration tools underscores Dicker Data’s potential for sustained growth. As ANZ businesses continue to adopt cutting-edge solutions, Dicker Data is well-equipped to meet their needs, leveraging its strong vendor relationships and market expertise to remain a leader in the ICT distribution space.

The ICT Wholesaling Industry

The ICT wholesaling industry serves as a critical link between technology vendors and businesses. ICT wholesalers purchase hardware and software from producers (vendors) and distribute these products to retailers or business partners (partners). In 2023, Dicker Data worked with more than 12,000 partners—over 10,000 in Australia and more than 2,000 in New Zealand—highlighting the scale of its operations and difficulty of any one vendor or partner maintaining this.

ICT wholesalers add value for their partners by streamlining procurement processes. Through their centralized operations, they connect individual partners with a wide range of vendors and their products. Beyond merely facilitating access, ICT wholesalers handle the logistics and storage of products, leveraging their economies of scale to reduce costs. Additionally, the expertise of an ICT wholesaler like Dicker Data allows them to provide tailored guidance to partners, particularly SMEs, which often lack the in-house resources to select or implement the best solutions.

For vendors, ICT wholesalers provide immense value by serving as a comprehensive sales channel. They give vendors access to a broad base of customers across a region, eliminating the need for the vendor to establish extensive direct-sales infrastructure. ICT wholesalers also manage logistics and support services, enabling vendors to focus on core production. Furthermore, wholesalers act as a feedback loop, leveraging their close relationships with end customers to relay insights that guide product development and customization.

Thin profit margins characterize the ICT wholesaling industry due to intense competition. Success hinges on accurate forecasting—wholesalers must predict partner demand for ICT products with precision. Overstocking can lead to excess inventory and forced discounts, while understocking risks losing customers to competitors due to delays or product unavailability. This delicate balance requires expertise in both demand analysis and vendor relationship management.

Dicker Data’s Competitors

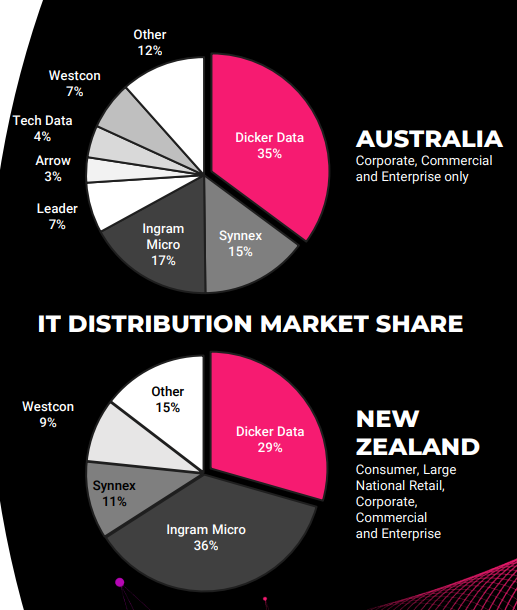

Dicker Data's largest competitors in the ANZ region are Ingram Micro and Synnex, two foreign multinational companies. Despite their global reach, these competitors do not appear to be as efficiently run as Dicker Data, with lower returns on capital and slower inventory turnover. Additionally, since most of their revenue comes from outside ANZ, these companies are likely less focused and responsive to the unique demands of the ANZ market.

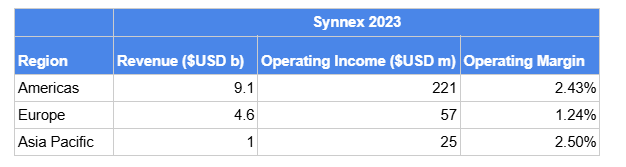

Synnex

Synnex derives the majority of its revenue from the Americas, with Europe as its second-largest market and Asia Pacific as its smallest. While its price-to-earnings (PE) ratio of around 16 makes it more affordable than Dicker Data from a valuation perspective, its historical performance suggests a lower-quality company. Synnex has shown slower earnings growth, lower margins, and other operational challenges compared to Dicker Data.

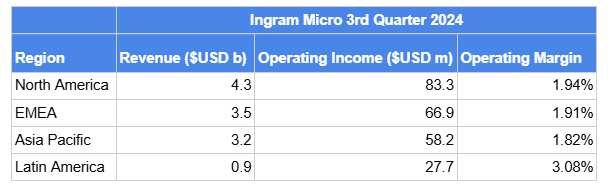

Ingram Micro

As the second-largest ICT distributor in Australia and the largest in New Zealand, Ingram Micro represents Dicker Data’s most direct competitor. However, its financials indicate a less efficient operation. Following its recent IPO after being spun out of private equity, Ingram Micro reported lower margins, particularly in the Asia Pacific region, which is only its third-largest market. Additionally, the company carries a significant debt load, with an interest coverage ratio of just 2.6 times, compared to Dicker Data’s much healthier 5.54 times.

Both competitors exhibit weaker financial metrics in comparison to Dicker Data, emphasizing the Dicker Data's stronger operational performance, focused market strategy, and superior financial discipline in the ANZ region.

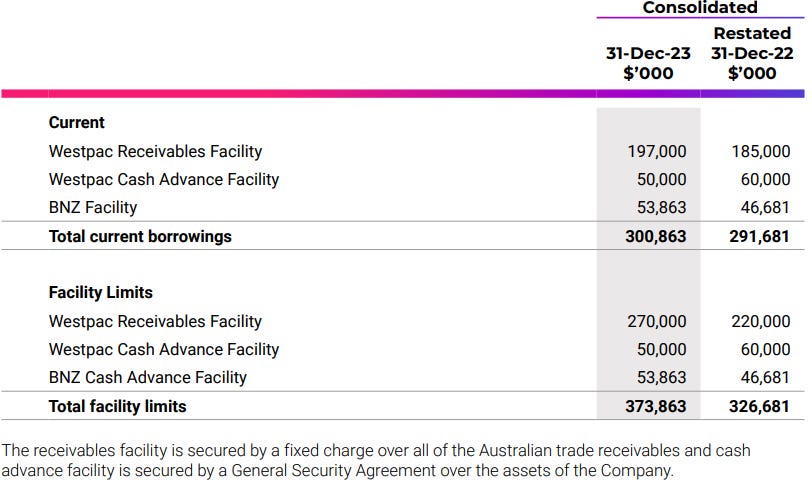

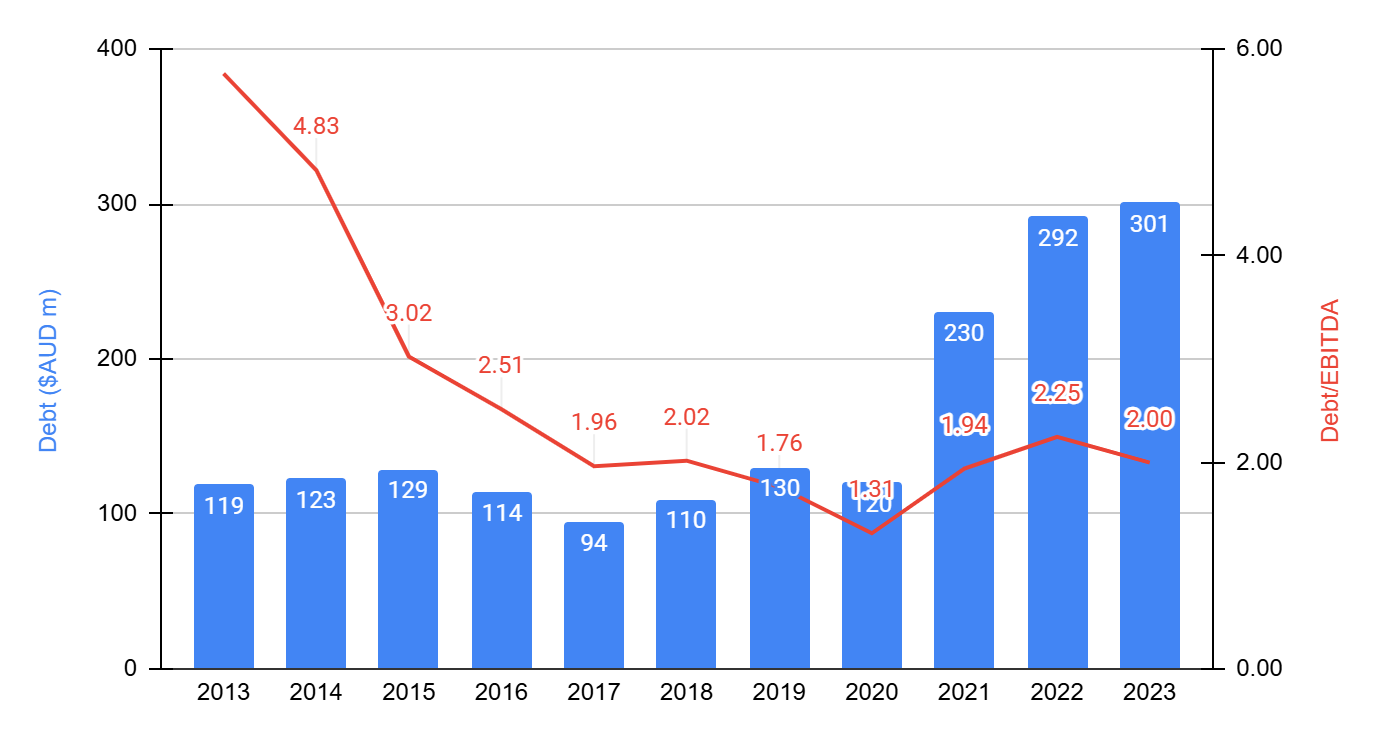

Dicker Data’s Balance Sheet

As of December 2023, Dicker Data reported a total debt of AUD 301 million, resulting in a Debt-to-EBITDA ratio of 2. The majority of this debt (AUD 197 million) is held under a receivables facility with Westpac, primarily used for working capital purposes. The remaining debt stems from the acquisition of Exceed Group and is divided between a Westpac Cash Advance Facility (AUD 50 million) and a facility with the Bank of New Zealand (BNZ) (AUD 53.86 million). The debt associated with the Exceed acquisition is being gradually repaid, while the receivables facility continues to support daily operations.

Debt Management Strategy

Dicker Data relies heavily on debt to fund its working capital, a strategy enabled by its policy of distributing 100% of net profits as dividends. While the company’s current debt levels are manageable and compare favorably with competitors Ingram Micro and Synnex, historical debt levels have occasionally been higher. Maintaining debt at or below the current level would be prudent to ensure long-term financial stability.

Dicker Data’s Management Team

David Dicker – Chief Executive Officer (CEO)

David Dicker, one of the company’s co-founders, has been with Dicker Data since its inception in 1978. As CEO, he holds 38,032,417 shares, demonstrating significant insider ownership. Recently, David sold 18.3 million shares, primarily due to a divorce settlement. He does not take a salary and focuses on building a unique management culture at the company.

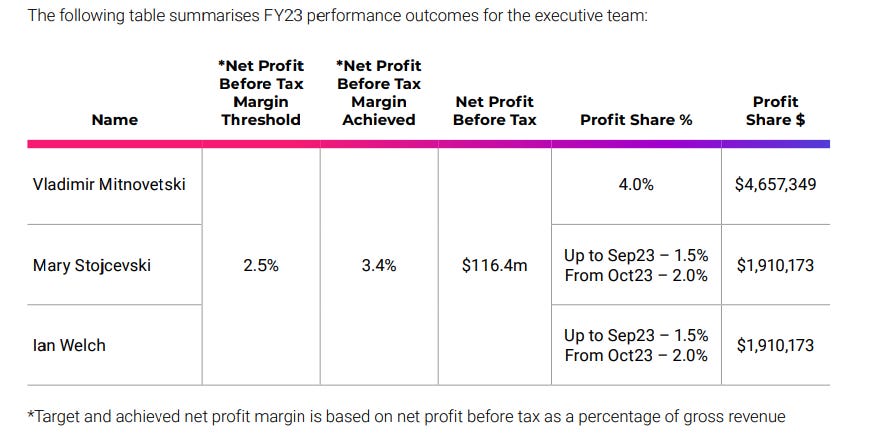

Vladimir Mitnovetski – Chief Operating Officer (COO)

Vladimir joined Dicker Data in 2010, bringing over 20 years of experience in the distribution industry. His career began at Tech Pacific, followed by a stint at Ingram Micro. Vladimir owns 930,176 shares and continues to increase his stake in the company, with his most recent purchase being 5,000 shares at $8.90 on September 4, 2024.

Mary Stojcevski – Chief Financial Officer (CFO)

Mary has been with Dicker Data since 1999 and has over 15 years of experience in accounting and taxation prior to joining. She owns 333,335 shares and has actively purchased shares, including 5,000 shares at $9.19 on May 21, 2024.

Ian Welch – Chief Information Officer (CIO) and Director of Operations

Ian Welch joined Dicker Data in 2013 after years of consulting for the company in various capacities. He holds 85,000 shares and recently purchased 5,000 shares at $9.05 on May 29, 2024.

Insider Ownership and Executive Compensation

Dicker Data’s management team has a strong track record, long tenures, and significant insider ownership. The executive compensation structure reflects David Dicker’s philosophy:

Executives receive relatively low base pay but are entitled to a percentage of net income before tax, provided the company maintains a net profit margin of at least 2.5%.

There is no long-term incentive plan, which has drawn criticism from some proxy advisors and investors.

There is no cap on executive compensation, which has also drawn criticism from proxy advisors and investors

David has defended the structure, stating:

“We’ve got people working for us who make a lot of money. They make way more money than they would make working at any of our competitors. And yet, we make more money than our competitors make.”

David Dicker’s Leadership and Future Focus

As a founder CEO, David Dicker’s leadership has shaped the unique management style and success of Dicker Data. He is known for his intense dedication, saying:

“You need a commitment bordering on obsession.”

However, in recent years, David has taken a step back from daily operations, focusing instead on strategic decisions and external interests. David has moved to Dubai and has also been focused on his Rodin racing car team and efforts to enter Formula 1, as well as his divorce. His absence at the most recent earnings presentation has raised questions about his ongoing involvement, though COO Vladimir Mitnovetski and the rest of the management team continue to maintain Dicker Data’s strong performance. Vlad seems particularly up to date with all the business details and now may present the bigger key person risk.

Dicker Data Valuation

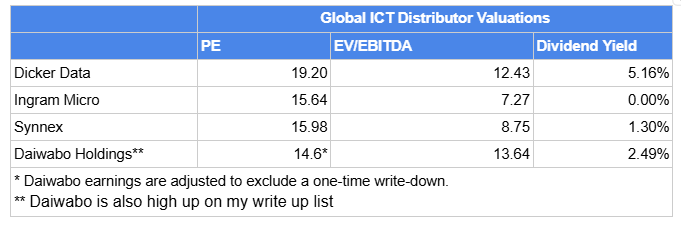

Over the past 5 years Dicker Data has traded at an average price-to-earnings (P/E) ratio of 27 times, this high number I think can be attributed to some Covid19 exuberance. Currently, the stock is trading at a P/E ratio of 19, reflecting a discount of nearly 30% compared to its historical average.

According to my discounted cash flow (DCF) model, the fair value of Dicker Data’s stock is estimated at $10.06, representing a 18% premium over its current price. The DCF model incorporates the following key assumptions:

Best-case growth rate of 10%, matching Dicker Data’s 10-year average.

Base-case growth rate of 7% for 5 years followed by 3% for another 5 years

Worst-case growth rate of 3%, implying the company maintains growth aligned with inflation.

Valuation is calculated with a margin of safety, reflecting a range of potential future scenarios.

While Dicker Data's stock appears to be undervalued compared to its historical P/E, it may seem somewhat expensive when compared to its peers. For example, competitors such as Ingram Micro and Synnex trade at lower valuation multiples, with average P/E ratios of 15.4 and EV/EBITDA ratios of 9.89. However, it's important to note that Dicker Data likely deserves a premium due to its stronger business fundamentals and its ability to outperform competitors. Furthermore, Dicker Data offers a relatively high dividend yield, currently 5.16%, which provides additional appeal, particularly to income-focused investors in the Australian market, where many investors value high dividend

Below is a good write up on Daiwabo

Despite trading at a higher multiple than some of its competitors, Dicker Data's superior business, and high dividend yield make it an attractive investment in the Australian stock market. While the stock does not present an outstanding value at its current price, it still offers a margin of safety for investors.

A number of aforementioned factors could make my growth estimates conservative, such as the upcoming end of support for Windows 10, which is expected to drive future demand for new ICT products. Additionally, the ANZ ICT market may currently be experiencing a cyclical low, influenced by the post-COVID economic slowdown and the impacts of higher interest rates on small-to-medium enterprises (SMEs).

Risks From Investing in Dicker Data

Macroeconomic and Competitive Landscape Risk

Dicker Data can be significantly influenced by external factors, beyond its control. The company's performance is closely tied to the economic conditions in the ANZ region. A slowdown in these economies can reduce demand for ICT products, impacting Dicker Data's immediate profits and leaving the company with excess inventory. This scenario can strain the industry’s already thin margins, forcing ICT distributors to discount their stock to clear excess supply. Conversely, if demand outpaces Dicker Data’s projections, the company may struggle to fulfill orders promptly, leading to dissatisfied customers and potential loss of market share.

Additionally, competitive pressure from global players in the ICT distribution industry can further squeeze margins, threatening Dicker Data’s profitability. With small profit margins being a defining feature of the industry, even slight shifts in competitive dynamics can significantly impact the bottom line.

To address these challenges, Dicker Data has implemented robust risk mitigation strategies, including:

Regular market monitoring to stay ahead of economic and industry trends.

Adaptive processes and business practices designed to respond swiftly to changing conditions.

Scenario modeling to anticipate and plan for sudden shifts in the external environment, ensuring the company can make informed decisions during periods of uncertainty.

These proactive measures help Dicker Data maintain its competitive edge, enabling it to navigate the challenges of a dynamic macroeconomic and competitive landscape.

People and Talent Risk

The ability to retain and motivate top talent is a critical success factor—and a potential risk—for Dicker Data. David Dicker, the company’s CEO, emphasizes offering the best rewards to attract and retain high-performing employees. David Dicker has said this has been a key driver behind Dicker Data’s superior performance compared to its competitors across various business areas. However, if key talent were to leave for competitors or if the company failed to attract skilled employees in the future, the business could face significant challenges.

To address this, Dicker Data has implemented several measures aimed at fostering employee retention and attracting top talent:

Competitive Compensation: Dicker Data distinguishes itself by providing exceptional rewards for exceptional performance. Its executives are among the highest-paid in the industry, reinforcing the company’s commitment to rewarding excellence.

Strong Organizational Culture: The company strives to be an employer of choice by cultivating a supportive culture and empowering leadership. This creates an environment where employees feel valued and motivated to excel.

Succession Planning: Dicker Data proactively plans for the future by identifying and developing internal talent, ensuring smooth transitions and long-term stability in leadership roles.

By prioritizing employee satisfaction and professional growth, Dicker Data not only mitigates the risks associated with talent attrition but also strengthens its competitive edge in the dynamic ICT distribution industry.

Technological Disruptions and Transformation Risk

As a distributor of ICT products and services, Dicker Data operates in an industry dominated by rapid innovation and change. To stay competitive, the company must constantly adapt to evolving technologies that meet the needs of its customers. However, technological disruption poses risks as it can significantly alter demand patterns. For example, the rise of cloud computing has reduced the need for certain traditional ICT products, such as on-site computer systems, which impacts Dicker Data’s product mix and revenue streams.

To navigate these challenges, Dicker Data has implemented strategies to stay ahead of technological transformations:

Collaboration with Partners: The company works closely with its partners to support the adoption of cutting-edge technologies that align with customer requirements.

Technology Roadmap and Strategy: Dicker Data develops and maintains forward-looking technology strategies to identify emerging trends and position itself for future opportunities.

Investment in Expertise: By equipping teams with the necessary resources and specialized knowledge, the company ensures agility in responding to technological shifts and disruptions.

Through these measures, Dicker Data demonstrates its commitment to innovation and its ability to adapt to a rapidly changing ICT landscape, helping it maintain relevance and competitiveness in the industry.

Supply Chain Disruption Risk

Dicker Data's business heavily depends on global supply chains to deliver products to its customers. This reliance on specific suppliers and regions exposes the company to risks, such as disruptions caused by weather events, supply shortages, or political instability. Any of these factors could delay product deliveries and impact the company's profitability.

To mitigate these risks, Dicker Data employs several strategies, including:

Flexible working capital management: The company can increase working capital as needed to navigate difficult conditions.

Strong contractual agreements: Dicker Data has established robust contracts and protections with its suppliers to ensure reliability.

Diversification of suppliers: The company continually works on expanding its supplier base and sourcing products from multiple regions to minimize dependence on any single source.

Refinance Risk

Dicker Data relies on working capital facilities provided by Westpac Banking Corporation and the Bank of New Zealand to support its operations. A failure to renew these facilities or to secure renewal under equally favorable terms could significantly impact the company’s profitability and even its ability to continue business operations.

To mitigate refinance risks, Dicker Data has implemented the following measures:

Strong Banking Relationships: The company prioritizes maintaining robust relationships with its financial institutions, ensuring trust and mutual confidence in its operations.

Dividend Policy Reassessment: Dicker Data remains open to reevaluating its dividend distribution policy, providing flexibility to retain more capital for operational needs if required.

These strategies reflect Dicker Data's proactive approach to managing financial risks and ensuring its long-term stability. By safeguarding its access to financing, the company strengthens its ability to weather economic uncertainties and sustain its growth trajectory.

Legal and Compliance Risk

Operating within the ICT distribution industry, Dicker Data must adhere to a wide array of laws, regulations, contracts, and agreements. Staying compliant is critical to avoiding legal repercussions and maintaining its reputation. Furthermore, the company must continuously monitor and adapt to evolving legal and regulatory frameworks, ensuring any breaches are promptly identified and addressed.

Dicker Data actively mitigates legal and compliance risks through the following measures:

Comprehensive Policies and Procedures: Implementation of mandatory policies, procedures, and ongoing training programs ensures employees are educated on key regulatory and compliance requirements.

Specialized Health and Safety Team: A dedicated in-house team oversees workplace health and safety, ensuring compliance with relevant standards while fostering a safe working environment.

By fostering a culture of compliance and maintaining robust oversight, Dicker Data minimizes legal risks and reinforces its commitment to ethical and lawful business practices.

Environmental, Social and Governance (ESG) Risk

As sustainability and ethical business practices become increasingly important, Dicker Data is committed to minimizing its environmental footprint and meeting regulatory standards. Beyond compliance, the company recognizes the reputational risks associated with failing to meet ESG expectations, which can impact its relationships with partners, investors, and customers.

To address ESG risks and achieve its sustainability goals, Dicker Data has implemented strategies such as:

ESG Governance Framework: A structured framework guides the company’s ESG initiatives, ensuring alignment with industry standards and best practices.

Dedicated ESG Team: A specialized team focuses on advancing Dicker Data's ESG credentials and driving impactful sustainability efforts.

Ongoing Oversight and Reviews: The management team regularly reviews ESG initiatives and risks to ensure progress and accountability.

By embedding ESG considerations into its operations, Dicker Data reinforces its commitment to responsible growth and aligns itself with the expectations of modern stakeholders.

Wellbeing, Health and Safety Risk

Maintaining a safe and healthy workplace is essential for Dicker Data to protect its employees and customers from both physical and psychological harm. Neglecting workplace safety could result in injuries, financial losses, and damage to the company’s reputation, impacting its ability to attract and retain talent as well as maintain client trust.

To mitigate these risks and foster a secure work environment, Dicker Data has implemented measures such as:

Dedicated Safety Teams: Specialized teams are in place to oversee health and safety protocols, supported by robust systems and controls.

Ongoing Monitoring and Training: Regular safety inspections, employee training, and proactive risk assessments ensure a consistent focus on workplace safety.

Incident and Injury Management: A structured approach to managing and addressing incidents minimizes downtime and supports affected employees effectively.

By prioritizing the wellbeing of its workforce, Dicker Data not only complies with regulatory requirements but also strengthens its reputation as a responsible and employee-focused organization.

Foreign Exchange

Dicker Data faces foreign exchange risk due to commercial transactions and assets or liabilities denominated in currencies other than its base currency. This risk arises from fluctuations in foreign currency values, which can impact the company’s profitability, particularly in its overseas procurement and sales operations.

To mitigate the impact of currency volatility, Dicker Data employs the following strategies:

Forward Foreign Exchange Contracts: The company proactively enters into agreements to lock in exchange rates for future transactions, reducing unpredictability.

Strategic Hedging Policies: Dicker Data hedges between 30% and 80% of foreign currency transactions for the next four months, with the flexibility to extend hedging up to 12 months for specific transactions.

By implementing these measures, Dicker Data minimizes the financial impact of exchange rate fluctuations, ensuring greater stability and predictability in its operations.

Conclusions

Dicker Data stands out as a high-quality business with a dominant position in the ANZ market for ICT product distribution. The company leads the Australian market and holds the second-largest market share in New Zealand, supported by strong growth and sustained demand. Additionally, Dicker Data is diversifying its offerings by expanding into verticals such as security systems, leveraging its competitive advantage in distributing technically complex products.

Despite these strengths, I do not plan to increase my stake in Dicker Data further at its current valuation. While the stock trades below my DCF price target by approximately 18%, I have identified other businesses—both in Australia and internationally—that offer a more favorable risk-return profile and trade at a greater discount to their intrinsic value.

In summary, while I believe Dicker Data offers above-market returns, I see more attractive opportunities elsewhere at this time. For now, I’ll continue to monitor the company closely, while exploring other high-potential investments that align with my valuation criteria.

* I have a small position in Dicker Data purchased at $8.5