Disclaimer:

The information provided in this Substack is for informational and educational purposes only and does not constitute financial product advice, investment advice, or a recommendation to buy, sell, or hold any financial products. The content is general in nature and does not take into account your personal financial objectives, situation, or needs.

While reasonable efforts are made to ensure the accuracy, completeness, and reliability of the information presented, no representation or warranty, express or implied, is given as to its accuracy or completeness. All opinions expressed are those of the author and are subject to change without notice.

I am not a licensed financial adviser. You should consult a licensed financial adviser, tax professional, or legal advisor before making any investment decisions. Investing involves risk, including the potential loss of capital, and past performance is not indicative of future results.

The author may hold positions in the securities mentioned and will disclose such holdings where relevant. Any mention of specific securities, investments, or strategies should not be interpreted as a recommendation.

By accessing and reading this content, you acknowledge and agree that the author is not liable for any loss or damage arising from any decisions you make based on the information provided. You are solely responsible for your own investment research and decisions.

I hold a position in B&M European Value Retail.

Key Purchase Reason:

“The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

Warren Buffett

“Dollar Stores” today are an important form of retail in a number of countries such as the United States, Canada and Japan. These stores originally sold goods for a dollar of 100 Yen in Japan, but today are simply discount variety retailers. In the USA the leading dollar stores chain Dollar General recently opened its 20,000th store, which gives it more stores than McDonald’s franchises in the United States. Despite this, dollar stores continue to grow and produce ever larger profits in many of these countries.

European countries have been slower to adopt the concept of dollar stores with some failed attempts such as Poundland in the UK. However, since 2004 with the takeover of B&M a struggling UK grocer by Bobby and Simon Arora the concept seems to be finally succeeding. B&M has thrived in the UK posting impressive growth, stronger margins and returns on capital than past attempts and existing UK retailers. With these impressive numbers, generous returns of capital to shareholders and growth potential, B&M is an above average business. However its valuation is relatively average for the cheap UK stock market and downright cheap relative to its more mature lower growth overseas peers.

Today B&M can continue reinvesting its profits at high rates of return into the foreseeable future by building new stores across the UK and France, not to mention potential expansion into other European markets. This offers investors long term compounding, but at value prices.

What does B&M do?

In B&M’s own words:

“Our business model is to directly source a targeted range of food, Fast Moving Consumer Goods (FMCG) and general merchandise products at the best prices we can, enabling us to sell them to customers at value prices. Our limited assortment of bestselling products enables us to constantly introduce new products and react quickly to what’s on trend and changes in demand patterns.”

So in Summary B&M sells a range of goods to consumers at low prices, is able to only sell the most popular goods due to a more limited assortment and introduce and try new goods rapidly.

B&M’s business is broken down by the company into three parts:

B&M stores in the UK: 707 (as of 2023 annual report) discount variety retailers in the UK.

B&M stores in France: 114 (as of 2023 annual report) discount variety retailers in France.

Heron Foods: 319 discount convenience stores in the UK.

The highest margin part of the business is B&M stores in the UK, as this is the oldest and largest part, but the margins for the other two parts of the business are catching up.

Moat

One of the reasons dollar stores have been successful is due to developing strong moats. They are generally initially dependent on each business's unique circumstances, which is why some are successful while others aren’t. But as they grow successful dollar stores tend to develop economies of scale based advantages by being able to spread out a large number of fixed costs across an ever larger number of stores and use their scale to get lower cost goods consumers are more likely to want.

Infrastructure

One feature of B&M’s success is a strong infrastructure able to get goods quickly and efficiently from B&M’s many suppliers to its store shelves. B&M now has six warehouses in the UK and boasts it can have stock on shelves within 24 hours of receipt in its warehouses.

In addition, it has also invested in its Information Technology (IT) infrastructure giving it the ability to track goods, monitor sales patterns and pay taxes and regulatory checks efficiently.

All this has a high fixed cost in terms of money and time and as B&M grows the cost of this will be spread out over more goods creating significant economies of scale for B&M and allowing it to get goods to consumers more quickly for less.

Supplier Relationships

B&M has a great number of suppliers who have reliably supplied it with high quality goods and as B&M has grown it has become more important to many of these suppliers. As a result of buying a great deal of products from these suppliers it can get greater bulk discounts and have a greater say on the qualities of goods these suppliers manufacture and even how they are manufactured.

Supplier relationships are an important part of retail, as the retailer needs to build trust that the supplier will supply consistently high quality goods and also fulfil regulatory requirements such as meeting minimum environmental and labour standards. B&M has operated long enough and successfully enough that it has identified and worked with suppliers that meet these requirements. Any potential competitor would have to identify similar suppliers and perform similar checks adding further economies of scale onto B&M’s moat.

Product Selection and Organisation

B&M needs to make sure it is stocking goods customers want. As such B&M has cultivated many long-time employees who have successfully since 2004 selected goods customers want as shown by their numbers, this included Bobby Aurora who has been trading director since their takeover in 2004. B&M also has an incumbent advantage being able to collect data and experiment in its large number of existing stores, allowing it to better select goods and even better organise stores, as they have shown in fitting more fresh produce into their Herons stores.

The format of dollar stores also allows B&M to have a higher return on each unit of shelf space. This is because dollar stores are generally much smaller than other store types they compete with such as grocery or hardware stores. But they are able to select goods from a wider array of categories not being limited to just groceries or hardware. So they select less goods from a wider selection allowing each good selected to be a better than average seller relative to other store formats.

Store Location

In an interview Simon Arora did shortly after stepping down as CEO of B&M he emphasised the amount of care he took in selecting each location of B&M, personally visiting and inspecting most sites. Now B&M has a very good idea of what makes a good site for a successful B&M and can select them very well. In addition the initial start-up costs of B&M stores and dollar stores in general are much cheaper than other retailers, so if a site is chosen that doesn’t perform well it can be shut down without too much loss, allowing the company to experiment.

One interesting thing found by B&M is its ability to not necessarily compete when next to a retail competitor like Aldi or Tesco, but to complement. When opening next to other retailers or having these retailers open near them they can adjust goods and prices such that more high quality retailers attract more customers and these customers shop at both stores for a variety of stores. Allowing them to complement each other.

Online Immunity

The goods sold at B&M are relatively low value goods, being in the category of dollar stores. This creates immunity to online retail for B&M as it makes it generally too expensive to ship goods, as the shipping would make up too large a share of the cost of the goods.

Brand

Finally B&M has built up a popular brand in the UK ranking 11th most loved retailer.

Earnings and General History

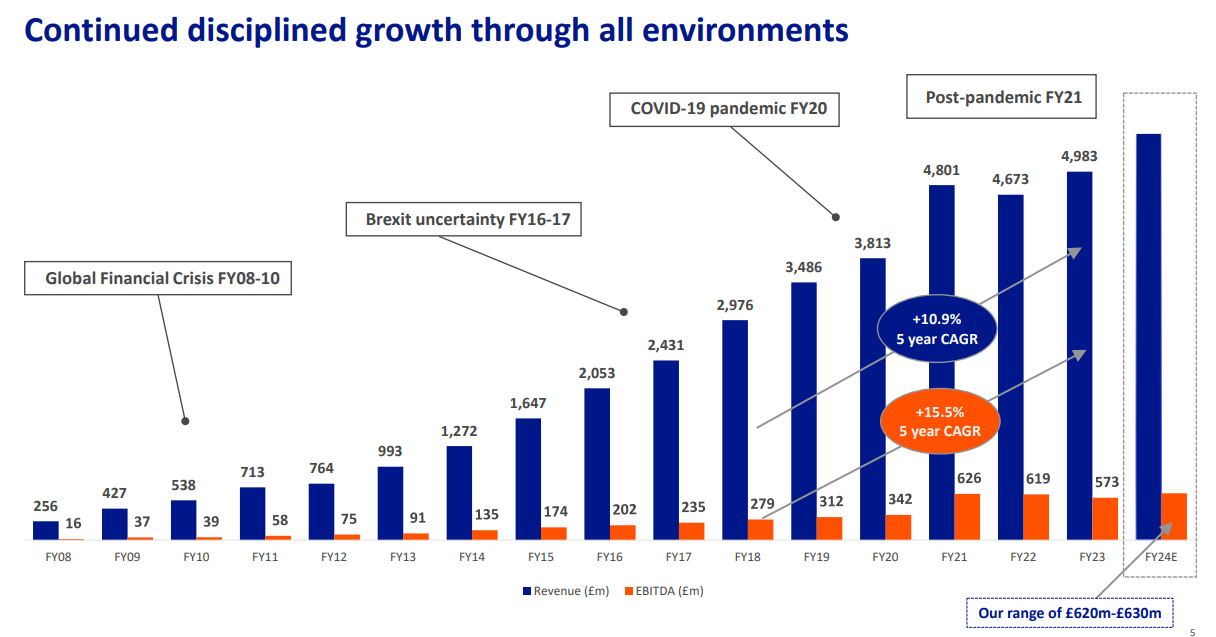

Since Simon and Bobby’s takeover of B&M in 2004 they have taken it from 20 shops in North West England struggling to survive to England's leading discount variety retailer with over 800 B&M stores across the UK and France and over 300 Herons in England. This has generated significant revenue growth and even greater profit growth with margins expanding as the business has scaled. This growth hasn’t come without mistakes with a failed expansion into Germany, but despite this failed experiment the business has continued to thrive in many varied economic conditions.

As can be seen in their revenues and profits from the period of 2021, the Covid pandemic proved to be a temporary boom for B&M. Due to a significant enough fraction of their revenue coming from groceries, B&M were able to stay open during the pandemic when other stores had to remain closed. As a result, although they were one of many opened stores where customers could buy groceries, they were one of the only opened stores where customers could buy hardware and other home improvement goods and B&M were able to rapidly adjust their stock to provide consumers with these goods.

After 2021 revenues and profits fell and there was a larger fall in same store sales because other stores supplying non-grocery items were able to re-open. However B&M has been able to re-start their store opening program, gradually increasing their store openings, which haven’t yet reached pre-Covid levels. In addition to that, the pandemic also allowed many consumers to discover B&M for the first time and although some have left the same stores sales are still above pre-pandemic levels.

B&M has a base dividend which they pay each year, but at least since 2021 have also paid out a special dividend most years. This is a good sign that when management has cash that is surplus to requirements they return it to shareholders rather than finding a way to retain it or potentially investing it inefficiently.

Industry

This year Dollar General, a dollar store chain in the USA opened its 20,000 stores, McDonalds as at the beginning of 2024 has just over 13,500 locations in the USA. Dollar General and Dollar Tree, the two leading dollar stores in the USA were the number 1 and 2 retailers in the USA for new store openings in 2023 according to retail analytics firm Coresight research. Dollar General was IPO’d in 2009 by private equity firm KKR and since then it has increased in value by approximately 27% annually, while also paying dividends.

In Japan 100 yen stores have grown their revenues from virtually nothing in the 1990’s to 400-500 billion yen (just under 2.6-3.5 billion USD) in the early 2000’s. Seria the second largest such stores (couldn’t find information on the largest Daiso) has grown its share price by an average of 14.8% since its IPO in 2003

Dollarama IPO’d in Canada in 2009 and since then has appreciated by about 26.9% annually.

Dollar stores on average have higher margins than regular retailers; selling cheap goods can be very profitable.

Dollar stores can be highly profitable for a variety of reasons:

One general reason is their limited selection of goods they choose to sell to consumers from a much larger potential range of goods. This is because dollar stores on average are smaller than your average supermarket, hardware or garden store in addition they can sell goods across multiple categories. So assuming it can adequately select goods customers want on average the goods it sells will have higher average sales.

Another general reason is they are a lot less cyclical than other retailers. Since these stores are known as discount retailers consumers perceive them as cheaper than regular retailers, so are more likely to visit when times are difficult. Dollar Stores can be very responsive to these consumer changes as due to the wide variety of goods they can retail they can rapidly adjust their selection to consumer tastes. As B&M did during the pandemic, increasing the range of gardening and home care goods they sold.

Dollar stores also have buying power when they reach sufficient scale. When a dollar store chain reaches a particular size it buys large amounts of goods from suppliers and so can get bulk discounts. In addition, due to its limited range it can’t supply the same range of brands that a larger retailer such as a supermarket can, so it can get better deals from brands in order for these brands to get a spot on its limited shelf space.

Other retailers are being hurt by online retail, but dollar stores are thriving. The average basket of goods purchased at a dollar store is pretty low and so if it had to be delivered delivery would make up too high a share of the value of the goods making it too expensive. In addition, with a large number of retailers being hurt and shutting down due to online retail real estate is much cheaper for dollar store expansion.

Dollar stores are not always an easy business to be in, especially in the UK as shown by the example of PoundLand, who was a UK dollar store chain that IPO’d in 2014. PoundLand had similar gross margins to US dollar stores but lower operating margins of only 4%, so in 2015 made an offer to buy one of its competitors called 99p. There were a number of problems with the takeover making it take a lot of time and by the time it was finalised 99p had deteriorated and was on the verge of bankruptcy, making the eventual conversion and upgrade of 99p’s stores much more expensive. In addition, overhead costs which PoundLand was hoping to spread over a larger number of stores through the takeover increased leading to limited synergies. Finally this was also a time of expansion in the UK for German discount supermarkets Aldi and Lidl. PoundLand went bankrupt in 2018.

Future Prospects

B&M has additional room to get back to its pre-covid growth rates in its two markets of the UK and France. In addition as it has shown throughout its history it should be able to continue finding ways to increase returns on capital through economies of scale and other means. Thus as the dollar store format has in past markets B&M has the ability to continue reinvesting shareholder capital at not only its current high rates of return but at potentially higher rates compounding shareholder returns.

Over the past few years B&M’s earnings haven’t really been representative of its actual potential. This is because of Covid, B&M in 2021 had unsustainably high earnings due to being one of the only stores selling particular goods such as hardware and outdoor furniture, while other stores who may sell these goods were forced to close due to not being classified as essential retailers. In addition during this period B&M was forced to halt its store expansion. So although its same store sales were up significantly its store expansion was stopped. Thus the pattern of B&M’s earnings from 2020-2023 should be seen in this light.

In 2023 B&M restarted its store expansion program which it was forced to put on hold due to Covid:

For B&M UK in 2023 30 new stores were opened; they hope to open an additional 40 in 2024, they currently have a target of opening 950 B&M stores in the UK, a 35% increase.

For B&M France only 7 new stores were opened in 2023, they hope to eventually open 20+ a year in the immediate future. The French economy is nearly as big as the UK economy so B&M could potentially open just as many new stores there and is today only at 114.

For Heron Foods this year B&M opened 14 new stores and plans to open 20 new stores in 2024. There are currently 319 stores in the UK.

As B&M opens stores in each of the above categories they are able to gain greater economies of scale in a number of ways as described above under their moat.

B&M is constantly evaluating each unit of store space and experimenting with new products and formats. This can be seen in B&M’s recent introduction of more fresh produce to its Heron Foods stores without removing any of the existing frozen products but storing them more efficiently. This has led to newer B&M stores being larger and more profitable than older ones and that as the older ones are refreshed they often become larger and more profitable.

Thus B&M is reinvesting its profits into new stores at high rates of return, while increasing those rates of return by becoming more efficient and making existing stores bigger and more profitable.

Balance Sheet

B&M has quite a healthy balance sheet with total liabilities of 2.867 billion. Just over 1.3 billion of this or nearly half is made up of lease liabilities. The next major component of liabilities is debt which is about 954 million, which are mostly non-current loans from B&M’s term facilities. With B&M's profit for the period of 348m this debt is very manageable at less than 3 times profit. It’s EBITDA in 2023 was 796 million making its debt relative to EBITDA a manageable 1.2 times.

Management Team

B&M was taken over and transformed by Simon and Bobby Aurora in 2004. Simon was the Chief Executive Officer (CEO) and Bobby was trading director of B&M. In September 2022 Simon stepped down as CEO of B&M after holding the role for 17 years, he was replaced by Alex Russo, the former Chief Financial Officer (CFO). In addition in 2022 the Arora holding company sold 234 million pounds of stock in B&M. The Arora’s holding company still hold a share of 6.98% of B&M representing about 365 million pounds.

The retirement of one of the founders and CEO of B&M as well as the sale of nearly forty percent of their remaining B&M holdings is a potential red flag. It can be looked at from two extremes with the actual answers likely lying somewhere in between.

The first point of view (extreme) is that this is a potential red flag in that one of the business founders has left and sold a large amount of shares because there is something wrong with the business or they don’t think the business can be run effectively without them.

The second point of view (extreme) on the other side and more positive for B&M relates to the business lifecycle and the different types of CEOs. As businesses grow they require different leaders with different skill sets. Simon has built two successful businesses in his life, first an import business he eventually sold and the second B&M, Simon may be great at starting and running businesses up until they get to a certain size, but when they reach a certain size a new skill set is required to run a business. Simon’s replacement Alex Russo does have expertise at larger retailers

https://pages.stern.nyu.edu/~adamodar/pdfiles/country/corporatelifecycleLongX.pdf

Business life Cycle by Aswath Damodaran.

I’m not saying either is the correct answer; I am just discussing two potential extremes. It likely has more to do with Simon’s life such as wanting to retire or do other things. But it’s also important to collect evidence to see which side it likely falls more under and at the moment there seems to be less evidence for there being something wrong with the business. Simon along with his brother still hold more than 6% of B&M and Simon’s brother Bobby still works for B&M. Shareholders should continue to be monitored for whether Alex Russo manages to implement greater returns on capital at B&M and the roll out of more high quality stores from his previous experience or some of those metrics take a turn for the worse.

Alex Russo is the current CEO, a position he has been in since September 2022. Prior to his appointment as CEO Alex was B&M’s CFO from November 2020. Before joining B&M Alex had held senior financial positions in a number of other retailers globally including Asda, Walmart, Tesco, Kingfisher and Boots. Thus Alex has senior experience at large retailers and can potentially bring his knowledge from these to B&M where appropriate. Although saying that this was financial rather than operational experience.

Mike Schmidt is the current CFO, a position he has held since October 2022. Prior to working at B&M Mike was CFO at home furniture retailer DFS Furniture, during his time at DFS Mike also held executive responsibilities over property, strategic development, legal and compliance.

Valuation

Similar businesses around the world who are more mature, but not generally growing as fast as B&M (Dollarama excluded) in general have higher valuations. In those markets these businesses are generally priced above average due to factors such as: their resiliency across economic conditions and immunity to online shopping. B&M is a clear outlier with how low it’s valuation is.

Running a discounted cash flow analysis on B&M with conservative assumptions ranging from maximum growth rates of 11% over certain scenarios and 0-5% in others I get a valuation for B&M implying a discount at the moment of just over 25%.

Thus B&M is a good buy at the moment valuation wise. At times over the past few years it has been even cheaper and so it’s definitely a stock to watch.

Risks

Management

As discussed above in the management section there has been a large handover from Simon Arora the founder of B&M to Alex Russo. I presented two extreme possibilities and this should be monitored especially whether the new CEO can bring about greater returns on capital and faster roll out of higher quality stores or those metrics degrade in the future.

In addition to B&M’s reliance on upper management another risk is improper training, poor incentives or improper succession planning for key management or leaders of operational teams.

Economic Environment

There have been a number of shocks both globally and in the UK to the economic environment, these include ongoing impacts from Brexit, inflation and changes in consumer confidence. Although B&M is generally a more resilient agile business as shown from it adapting to changes such as Covid, large changes in any of the aforementioned or other macro-economic factors could still hurt B&M.

Supply Chain

B&M has a heavy reliance on supply of its goods from China and Southeast Asia, any disruption to this would be damaging to B&M.

In addition all factories and suppliers need to be monitored for potential breaches in conduct such as slavery, environmental problems or human trafficking.

Competition

B&M operates in the highly competitive retail environments of the UK and France. They need to continuously monitor their pricing, products and formats and that of their competitors.

They also need to continuously experiment with new categories, formats and targeting of new customers to ensure they stay ahead of the competition.

Regulation and Compliance

The group has a range of compliance issues including: importation of goods, pricing, anti-bribery and corruption, anti-slavery, anti-tax avoidance, health and safety, employment law, data protection, pollution and contamination of the environment, listing rules, transparency laws and regulations. These could lead to financial penalties or loss of reputation.

International Expansion

A part of B&M and a significant part of B&Ms growth plans involve international expansion. As a result B&M needs to make sure it has experienced leaders in France and is able to share any economies of scale and advantages from its UK business.

In addition expansion into new markets needs to be closely monitored as it is not positive as learnt from their expansion into Germany.

Warehouse Infrastructure

Loss of a distribution centre or failure to maintain distribution centres and transport infrastructure could significantly impact short/medium term profitability. B&M has multiple warehouses across the UK with plans for more to support future growth as well as business interruption insurance.

IT System, Cyber Security and Business Continuity

B&M relies on IT systems in stores and warehouses. Failure of such systems would have significant impacts: business interruption, reputation damage, loss of personal data leading to prosecution. All systems have industry standard maintenance contracts, B&M has a group recovery plan and IT budgets and security is reviewed at board level.

Store Expansion

To grow, B&M needs to find suitable locations for its new stores, failure to find these could reduce the growth rate. Each new store is approved by the CEO to ensure risks are minimised and lease length appropriate. B&Ms flexible low cost format allows good locations to be taken advantage of and if these don’t work out the loss is minimised by its cheap format.

Stock Management

Ineffective controls over stock, lack of product availability or overstocking may impact B&Ms margins, cash flows and working capital. To deal with this B&M has a limited SKU count with markdowns on slow moving goods and non-seasonal stocking doesn’t exceed 12 weeks supply.

Summary

B&M has many aforementioned qualities that make it an above average business and worthy of an above average valuation.

It is growing and has room to not only expand locations significantly but also improve efficiency.

It also has high returns on capital and an ability to further increase those returns.

It is from a sector of retail which is not only likely immune to online shopping, but much less cyclical than other areas of the economy. That has in other countries generated great returns.

Finally it is generous to its shareholders paying out special dividends when it makes money it doesn’t need rather than retaining it unnecessarily.

There are a few areas which should be monitored in B&M at the moment:

Whether the management change over from Simon Arora to Alex Russo, will be positive for the business

Any future international expansions do better than their failed German one.

Overall B&M is a growing resilient that can continue reinvesting capital at higher rates of return for its shareholders. It is cheap, even in a cheap stock market like the UK. Thus I would currently classify it as a buy.

During more normal times prior to Covid B&M was able to grow earnings per share at about 10%-15% per year. Dividends excluding special dividends at the current valuation are at 2.5%. SO assuming no special dividends or multiple expansion B&M is a resilient company that can potentially generate 12.5%-17.5% annual returns.

I am long B&M at a slightly lower value than where it is today.

Did you mean PoundWorld instead of PoundLand when you were writing about the bankruptcy?